Extra material: Refinery production and shadow pricing#

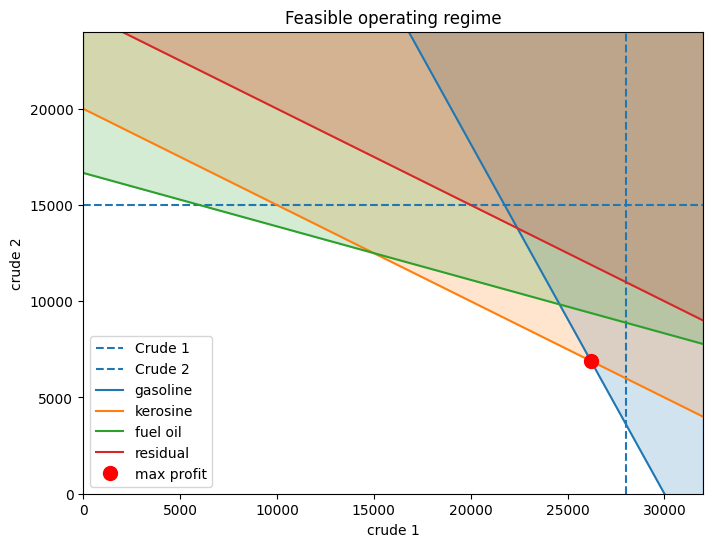

This is a simple linear optimization problem in six variables, but with four equality constraints it allows for a graphical explanation of some unusually large shadow prices for manufacturing capacity.

# install AMPL and solvers

%pip install -q amplpy pandas numpy matplotlib

SOLVER = "cbc"

from amplpy import AMPL, ampl_notebook

ampl = ampl_notebook(

modules=["coin"], # modules to install

license_uuid="default", # license to use

) # instantiate AMPL object and register magics

Using default Community Edition License for Colab. Get yours at: https://ampl.com/ce

Licensed to AMPL Community Edition License for the AMPL Model Colaboratory (https://ampl.com/colab).

This example derived from Example 19.3 from Seborg, Edgar, Mellichamp, and Doyle.

Seborg, Dale E., Thomas F. Edgar, Duncan A. Mellichamp, and Francis J. Doyle III. Process dynamics and control. John Wiley & Sons, 2016.

The changes include updating prices, new solutions using optimization modeling languages, adding constraints, and adjusting parameter values to demonstrate the significance of duals and their interpretation as shadow prices.

Problem data#

import pandas as pd

products = pd.DataFrame(

{

"gasoline": {"capacity": 24000, "price": 108},

"kerosine": {"capacity": 2000, "price": 72},

"fuel oil": {"capacity": 6000, "price": 63},

"residual": {"capacity": 2500, "price": 30},

}

).T

crudes = pd.DataFrame(

{

"crude 1": {"available": 28000, "price": 72, "process_cost": 1.5},

"crude 2": {"available": 15000, "price": 45, "process_cost": 3},

}

).T

# note: volumetric yields may not add to 100%

yields = pd.DataFrame(

{

"crude 1": {"gasoline": 80, "kerosine": 5, "fuel oil": 10, "residual": 5},

"crude 2": {"gasoline": 44, "kerosine": 10, "fuel oil": 36, "residual": 10},

}

).T

display(products)

display(crudes)

display(yields)

| capacity | price | |

|---|---|---|

| gasoline | 24000 | 108 |

| kerosine | 2000 | 72 |

| fuel oil | 6000 | 63 |

| residual | 2500 | 30 |

| available | price | process_cost | |

|---|---|---|---|

| crude 1 | 28000.0 | 72.0 | 1.5 |

| crude 2 | 15000.0 | 45.0 | 3.0 |

| gasoline | kerosine | fuel oil | residual | |

|---|---|---|---|---|

| crude 1 | 80 | 5 | 10 | 5 |

| crude 2 | 44 | 10 | 36 | 10 |

AMPL Model#

%%writefile refinery.mod

set CRUDES;

set PRODUCTS;

param price {PRODUCTS union CRUDES}; # selling price for products, purchase price for crudes

param process_cost {CRUDES};

param yields {PRODUCTS, CRUDES}; # percent yields (0..100)

param available {CRUDES};

param capacity {PRODUCTS};

# decision variables

var x {c in CRUDES} >= 0; # crude consumption

var y {p in PRODUCTS} >= 0; # product production

# objective

maximize profit:

sum {p in PRODUCTS} price[p] * y[p]

- sum {c in CRUDES} price[c] * x[c]

- sum {c in CRUDES} process_cost[c] * x[c];

# constraints

subject to balances {p in PRODUCTS}:

y[p] = sum {c in CRUDES} yields[p,c] * x[c] / 100;

subject to feed_limit {c in CRUDES}:

x[c] <= available[c];

subject to cap_limit {p in PRODUCTS}:

y[p] <= capacity[p];

Overwriting refinery.mod

m = AMPL()

m.read("refinery.mod")

m.set_data(crudes, "CRUDES")

m.set_data(products, "PRODUCTS")

m.param["yields"] = yields.T

# solution

m.solve(solver=SOLVER, verbose=False)

assert m.solve_result == "solved", m.solve_result

print(f"Profit: {m.obj['profit'].value():0.2f}\n")

# -----------------------

# Extract primals

# -----------------------

x = m.var["x"].get_values().to_pandas()

y = m.var["y"].get_values().to_pandas()

# -----------------------

# Extract duals (shadow prices)

# -----------------------

feed_dual = m.con["feed_limit"].get_values("dual").to_pandas() # column "dual"

cap_dual = m.con["cap_limit"].get_values("dual").to_pandas()

bal_dual = m.con["balances"].get_values("dual").to_pandas()

Profit: 860275.86

Crude oil feed results#

results_crudes = crudes

results_crudes["consumption"] = x.values

results_crudes["shadow price"] = feed_dual

display(results_crudes.round(1))

| available | price | process_cost | consumption | shadow price | |

|---|---|---|---|---|---|

| crude 1 | 28000.0 | 72.0 | 1.5 | 26206.9 | 0 |

| crude 2 | 15000.0 | 45.0 | 3.0 | 6896.6 | 0 |

Refinery production results#

results_products = products

results_products["production"] = y.reindex(results_products.index)

results_products["unused capacity"] = (

results_products["capacity"] - results_products["production"]

)

results_products["shadow price"] = cap_dual

display(results_products.round(1))

| capacity | price | production | unused capacity | shadow price | |

|---|---|---|---|---|---|

| gasoline | 24000 | 108 | 24000.0 | 0.0 | 14.0 |

| kerosine | 2000 | 72 | 2000.0 | 0.0 | 262.6 |

| fuel oil | 6000 | 63 | 5103.4 | 896.6 | 0.0 |

| residual | 2500 | 30 | 2000.0 | 500.0 | 0.0 |

Why is the shadow price of kerosine so high?#

import matplotlib.pyplot as plt

import numpy as np

fig, ax = plt.subplots(figsize=(8, 6))

ylim = 24000

xlim = 32000

ax.axvline(crudes["available"].iloc[0], linestyle="--", label="Crude 1")

ax.axhline(crudes["available"].iloc[1], linestyle="--", label="Crude 2")

xplot = np.linspace(0, xlim)

for product in products.index:

b = 100 * products.loc[product, "capacity"] / yields[product].iloc[1]

m = -yields[product].iloc[0] / yields[product].iloc[1]

line = ax.plot(xplot, m * xplot + b, label=product)

ax.fill_between(xplot, m * xplot + b, 30000, color=line[0].get_color(), alpha=0.2)

ax.plot(x.values[0], x.values[1], "ro", ms=10, label="max profit")

ax.set_title("Feasible operating regime")

ax.set_xlabel(crudes.index[0])

ax.set_ylabel(crudes.index[1])

ax.legend()

ax.set_xlim(0, xlim)

ax.set_ylim(0, ylim)

(0.0, 24000.0)

Suggested Exercises#

Suppose the refinery makes a substantial investment to double kerosene production in order to increase profits. What becomes the limiting constraint?

How do prices of crude oil and refinery products change the location of the optimum operating point?

A refinery is a financial asset for the conversion of commodity crude oils into commodity hydrocarbons. What economic value can be assigned to owning the option to convert crude oils into other commodities?