Enhanced Sector ETF Portfolio Optimization with Multiple Strategies in Python with AMPL#

Description: This notebook compares multiple portfolio optimization strategies for invesment in Sector ETFs

Tags: finance, portfolio-optimization

Notebook author: Mukeshwaran Baskaran <mukesh96official@gmail.com>

Introduction#

This notebook helps you make better investment decisions by optimizing a portfolio of sector ETFS. It uses different portfolio optimisation strategies to decide how much of your money should go into each ETF. The goal is to balance risk and potential gains. The notebook shows you how different strategies perform over time and helps you compare their results. AMPL helps to perform this optimisation.

# Install dependencies

%pip install amplpy yfinance seaborn matplotlib pandas numpy -q

# Google Colab & Kaggle integration

from amplpy import AMPL, ampl_notebook

ampl = ampl_notebook(

modules=["gurobi"], # modules to install

license_uuid="default", # license to use

) # instantiate AMPL object and register magics

Implementation#

Import libraries#

import yfinance as yf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

Define constants#

# Define sector ETFs

SECTOR_ETFS = [

"XLK", # Technology

"XLF", # Financials

"XLV", # Healthcare

"XLE", # Energy

"XLY", # Consumer Discretionary

"XLC", # Communication Services

"VWO", # Vanguard Emerging Markets (Global Exposure)

"BND", # Vanguard Total Bond Market ETF (Fixed Income)

"GLD", # SPDR Gold Shares (Commodity, Gold)

]

START_DATE = "2007-01-01"

END_DATE = "2020-01-01"

Download historical data for sector ETFs#

def fetch_sector_data(tickers, start_date, end_date):

"""Fetch historical data for given tickers."""

data = yf.download(tickers, start=start_date, end=end_date)["Close"]

if data.empty:

raise ValueError("No data fetched. Check tickers and date range.")

return data

Calculate returns and covariance matrix#

def calculate_statistics(data):

"""Calculate daily returns and covariance matrix."""

returns = data.pct_change().dropna()

cov_matrix = returns.cov().values

mean_returns = returns.mean().values

return returns, cov_matrix, mean_returns

Minimum Variance Optimization using AMPL#

def minimum_variance_optimization(tickers, cov_matrix):

"""Perform minimum variance optimization."""

ampl = AMPL()

ampl.eval(

r"""

set A ordered; # Set of assets

param S{A, A}; # Covariance matrix

var w{A} >= 0 <= 1; # Portfolio weights

minimize min_variance:

sum {i in A, j in A} w[i] * S[i, j] * w[j]; # Objective: minimize variance

s.t. portfolio_weights:

sum {i in A} w[i] = 1; # Constraint: weights sum to 1

"""

)

ampl.set["A"] = tickers

ampl.param["S"] = pd.DataFrame(cov_matrix, index=tickers, columns=tickers)

ampl.solve(solver="gurobi", mp_options="outlev=1")

assert ampl.solve_result == "solved", ampl.solve_result

return pd.Series(ampl.var["w"].to_dict())

Markowitz (Mean-Variance) Optimization using AMPL#

def markowitz_optimization(tickers, cov_matrix, mean_returns, risk_tolerance):

"""Perform Markowitz mean-variance optimization."""

ampl = AMPL()

ampl.eval(

r"""

set A ordered; # Set of assets

param S{A, A}; # Covariance matrix

param mu{A}; # Expected returns

param gamma; # Risk tolerance

var w{A} >= 0 <= 1; # Portfolio weights

maximize expected_return:

sum {i in A} mu[i] * w[i]; # Objective: maximize expected return

s.t. portfolio_weights:

sum {i in A} w[i] = 1; # Constraint: weights sum to 1

s.t. risk_constraint:

sum {i in A, j in A} w[i] * S[i, j] * w[j] <= gamma; # Risk constraint

"""

)

ampl.set["A"] = tickers

ampl.param["S"] = pd.DataFrame(cov_matrix, index=tickers, columns=tickers)

ampl.param["mu"] = pd.Series(mean_returns, index=tickers)

ampl.param["gamma"] = risk_tolerance

ampl.solve(solver="gurobi", mp_options="outlev=1")

assert ampl.solve_result == "solved", ampl.solve_result

return pd.Series(ampl.var["w"].to_dict())

Equal-Weighted Portfolio#

def equal_weighted_portfolio(tickers):

"""Equal-weighted portfolio."""

n_assets = len(tickers)

return pd.Series(np.ones(n_assets) / n_assets, index=tickers)

Plot portfolio weights comparison#

def plot_weights_comparison(weights_dict):

"""Plot comparison of portfolio weights across strategies."""

weights_df = pd.DataFrame(weights_dict)

weights_df.plot(kind="bar", figsize=(14, 7), colormap="viridis")

plt.title("Portfolio Weights Comparison", fontsize=18, fontweight="bold")

plt.xlabel("Asset")

plt.ylabel("Weight")

plt.xticks(rotation=0)

plt.grid(True)

plt.show()

Plot cumulative returns#

def plot_cumulative_returns(returns, weights_dict):

"""Plot cumulative returns for each strategy."""

plt.figure(figsize=(14, 7))

for strategy, weights in weights_dict.items():

portfolio_returns = returns.dot(weights)

cumulative_returns = (1 + portfolio_returns).cumprod() - 1

plt.plot(cumulative_returns, label=strategy)

plt.title("Cumulative Returns by Strategy", fontsize=18, fontweight="bold")

plt.xlabel("Date")

plt.ylabel("Cumulative Returns")

plt.legend()

plt.grid(True)

plt.show()

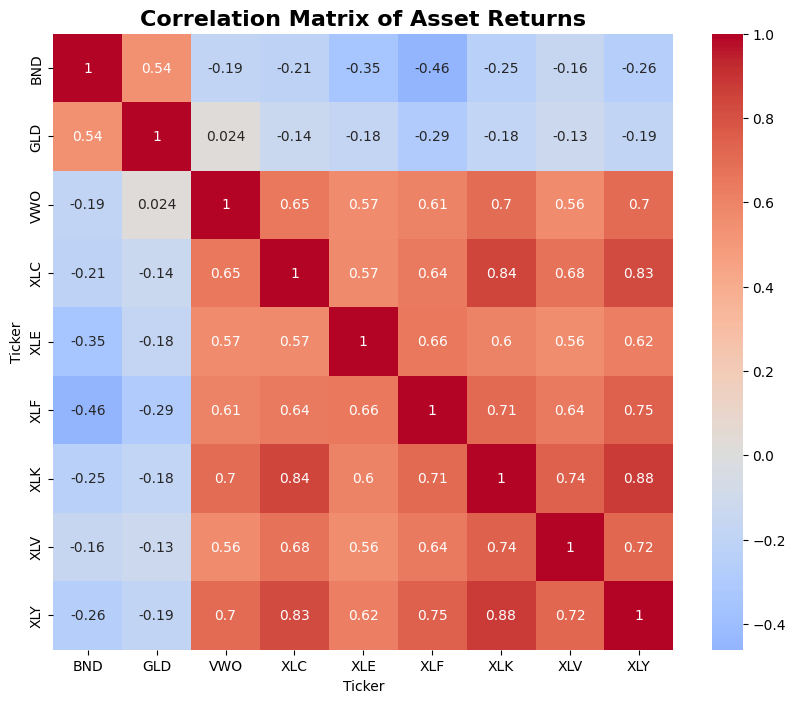

Plot correlation matrix#

def plot_correlation_matrix(returns):

"""Plot correlation matrix of asset returns."""

plt.figure(figsize=(10, 8))

sns.heatmap(returns.corr(), annot=True, cmap="coolwarm", center=0)

plt.title("Correlation Matrix of Asset Returns", fontsize=16, fontweight="bold")

plt.show()

Calculate portfolio performance metrics#

def calculate_performance_metrics(returns, weights, risk_free_rate=0):

"""Calculate portfolio performance metrics."""

portfolio_returns = returns.dot(weights)

cumulative_returns = (1 + portfolio_returns).cumprod() - 1

annualized_return = portfolio_returns.mean() * 252

annualized_volatility = portfolio_returns.std() * np.sqrt(252)

sharpe_ratio = (annualized_return - risk_free_rate) / annualized_volatility

sortino_ratio = (annualized_return - risk_free_rate) / (

portfolio_returns[portfolio_returns < 0].std() * np.sqrt(252)

)

max_drawdown = (cumulative_returns / cumulative_returns.cummax() - 1).min()

return {

"Annualized Return": annualized_return,

"Annualized Volatility": annualized_volatility,

"Sharpe Ratio": sharpe_ratio,

"Sortino Ratio": sortino_ratio,

"Max Drawdown": max_drawdown,

}

Execution#

Fetch data#

sector_data = fetch_sector_data(SECTOR_ETFS, START_DATE, END_DATE)

[*********************100%***********************] 9 of 9 completed

Calculate statistics#

returns, cov_matrix, mean_returns = calculate_statistics(sector_data)

Optimize portfolios using AMPL#

# Equal weights

equal_weights = equal_weighted_portfolio(SECTOR_ETFS)

# Minimum variance

min_var_weights = minimum_variance_optimization(SECTOR_ETFS, cov_matrix)

# Markowitz Optimization (Mean-Variance)

risk_tolerance = 0.01 # Set risk tolerance (gamma)

markowitz_weights = markowitz_optimization(

SECTOR_ETFS, cov_matrix, mean_returns, risk_tolerance

)

Gurobi 12.0.1: Set parameter LogToConsole to value 1

tech:outlev = 1

AMPL MP initial flat model has 9 variables (0 integer, 0 binary);

Objectives: 1 quadratic;

Constraints: 1 linear;

AMPL MP final model has 9 variables (0 integer, 0 binary);

Objectives: 1 quadratic;

Constraints: 1 linear;

Set parameter InfUnbdInfo to value 1

Gurobi Optimizer version 12.0.1 build v12.0.1rc0 (linux64 - "Ubuntu 22.04.4 LTS")

CPU model: Intel(R) Xeon(R) CPU @ 2.20GHz, instruction set [SSE2|AVX|AVX2]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

Non-default parameters:

InfUnbdInfo 1

Optimize a model with 1 rows, 9 columns and 9 nonzeros

Model fingerprint: 0xfb514690

Model has 45 quadratic objective terms

Coefficient statistics:

Matrix range [1e+00, 1e+00]

Objective range [0e+00, 0e+00]

QObjective range [7e-06, 5e-04]

Bounds range [1e+00, 1e+00]

RHS range [1e+00, 1e+00]

Presolve time: 0.01s

Presolved: 1 rows, 9 columns, 9 nonzeros

Presolved model has 45 quadratic objective terms

Ordering time: 0.00s

Barrier statistics:

Free vars : 8

AA' NZ : 3.600e+01

Factor NZ : 4.500e+01

Factor Ops : 2.850e+02 (less than 1 second per iteration)

Threads : 1

Objective Residual

Iter Primal Dual Primal Dual Compl Time

0 1.25232225e+02 -1.25232225e+02 5.65e+03 8.22e-06 2.51e+05 0s

1 8.57489025e+00 -8.72605186e+00 3.90e+02 5.67e-07 1.92e+04 0s

2 2.47070577e-03 -2.32928472e-01 3.77e+00 5.49e-09 2.19e+02 0s

3 1.51345511e-05 -1.78829828e-01 3.77e-06 2.64e-13 2.03e+01 0s

4 1.51260842e-05 -2.03947512e-04 8.50e-10 3.02e-14 2.49e-02 0s

5 1.06016264e-05 -1.29169103e-05 4.32e-11 1.30e-15 2.68e-03 0s

6 5.20728375e-06 -3.41869179e-06 2.22e-16 6.94e-18 9.81e-04 0s

7 2.84137060e-06 1.90761719e-06 1.11e-16 1.04e-17 1.06e-04 0s

8 2.47149758e-06 2.39215423e-06 1.28e-15 5.20e-18 9.03e-06 0s

9 2.40295914e-06 2.39981640e-06 3.89e-15 5.94e-18 3.58e-07 0s

10 2.40000682e-06 2.40000195e-06 9.60e-15 5.20e-18 5.53e-10 0s

Barrier solved model in 10 iterations and 0.01 seconds (0.00 work units)

Optimal objective 2.40000682e-06

Gurobi 12.0.1: optimal solution; objective 2.400006815e-06

0 simplex iterations

10 barrier iterations

Gurobi 12.0.1: Set parameter LogToConsole to value 1

tech:outlev = 1

AMPL MP initial flat model has 9 variables (0 integer, 0 binary);

Objectives: 1 linear;

Constraints: 1 linear; 1 quadratic;

AMPL MP final model has 9 variables (0 integer, 0 binary);

Objectives: 1 linear;

Constraints: 1 linear; 1 quadratic;

Set parameter InfUnbdInfo to value 1

Gurobi Optimizer version 12.0.1 build v12.0.1rc0 (linux64 - "Ubuntu 22.04.4 LTS")

CPU model: Intel(R) Xeon(R) CPU @ 2.20GHz, instruction set [SSE2|AVX|AVX2]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

Non-default parameters:

InfUnbdInfo 1

Optimize a model with 1 rows, 9 columns and 9 nonzeros

Model fingerprint: 0x7908852a

Model has 1 quadratic constraint

Coefficient statistics:

Matrix range [1e+00, 1e+00]

QMatrix range [4e-06, 3e-04]

Objective range [3e-04, 8e-04]

Bounds range [1e+00, 1e+00]

RHS range [1e+00, 1e+00]

QRHS range [1e-02, 1e-02]

Presolve time: 0.00s

Presolved: 1 rows, 9 columns, 9 nonzeros

Ordering time: 0.00s

Barrier statistics:

AA' NZ : 0.000e+00

Factor NZ : 1.000e+00

Factor Ops : 1.000e+00 (less than 1 second per iteration)

Threads : 1

Objective Residual

Iter Primal Dual Primal Dual Compl Time

0 1.13321944e-03 3.62712815e-04 2.12e+00 5.43e-02 1.10e-02 0s

1 5.50940323e-04 6.64102975e-04 2.22e-16 1.57e-02 1.47e-03 0s

2 7.82262227e-04 7.87098032e-04 2.58e-14 1.39e-17 3.44e-05 0s

3 7.86615830e-04 7.86620666e-04 0.00e+00 3.47e-17 3.44e-08 0s

4 7.86620174e-04 7.86620179e-04 2.22e-16 6.94e-18 3.44e-11 0s

Barrier solved model in 4 iterations and 0.00 seconds (0.00 work units)

Optimal objective 7.86620174e-04

Warning: to get QCP duals, please set parameter QCPDual to 1

Gurobi 12.0.1: optimal solution; objective 0.0007866201743

0 simplex iterations

4 barrier iterations

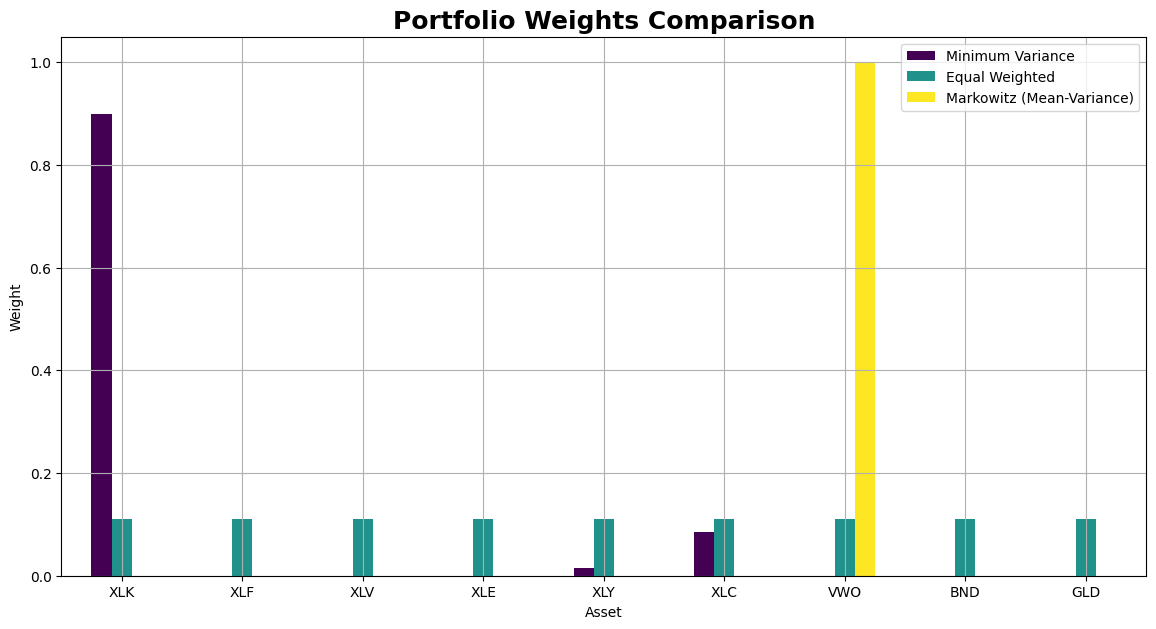

Compare portfolio weights#

weights_dict = {

"Minimum Variance": min_var_weights,

"Equal Weighted": equal_weights,

"Markowitz (Mean-Variance)": markowitz_weights,

}

plot_weights_comparison(weights_dict)

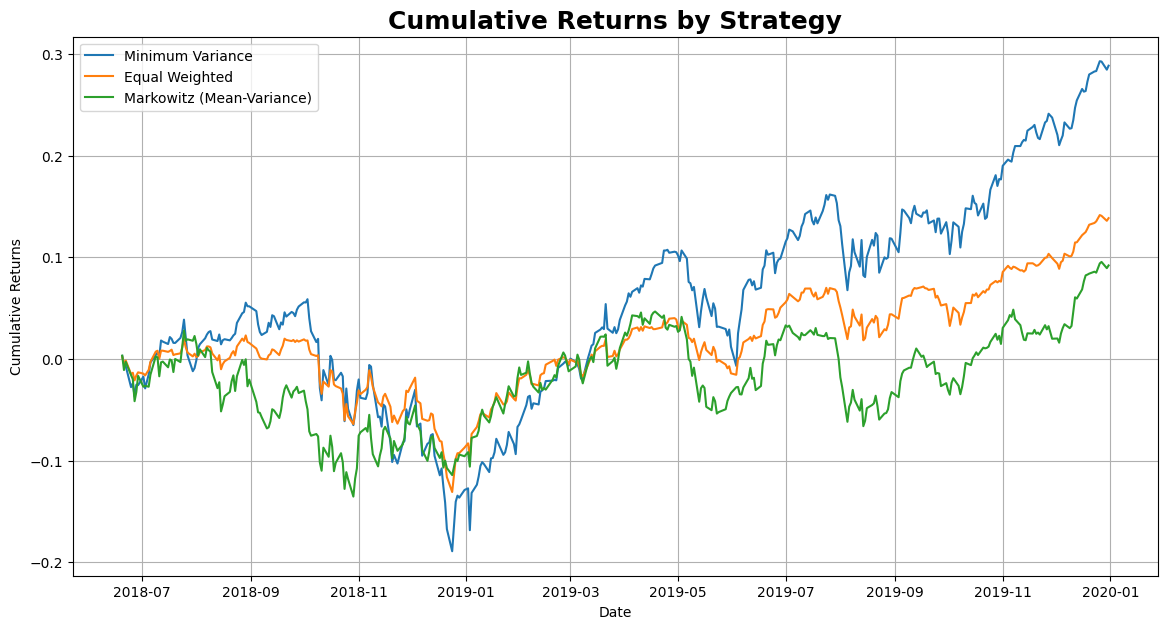

Plot cumulative returns#

plot_cumulative_returns(returns, weights_dict)

Plot correlation matrix#

plot_correlation_matrix(returns)

Compare performance metrics#

performance_metrics = {}

for strategy, weights in weights_dict.items():

performance_metrics[strategy] = calculate_performance_metrics(returns, weights)

performance_df = pd.DataFrame(performance_metrics).T

print(performance_df)

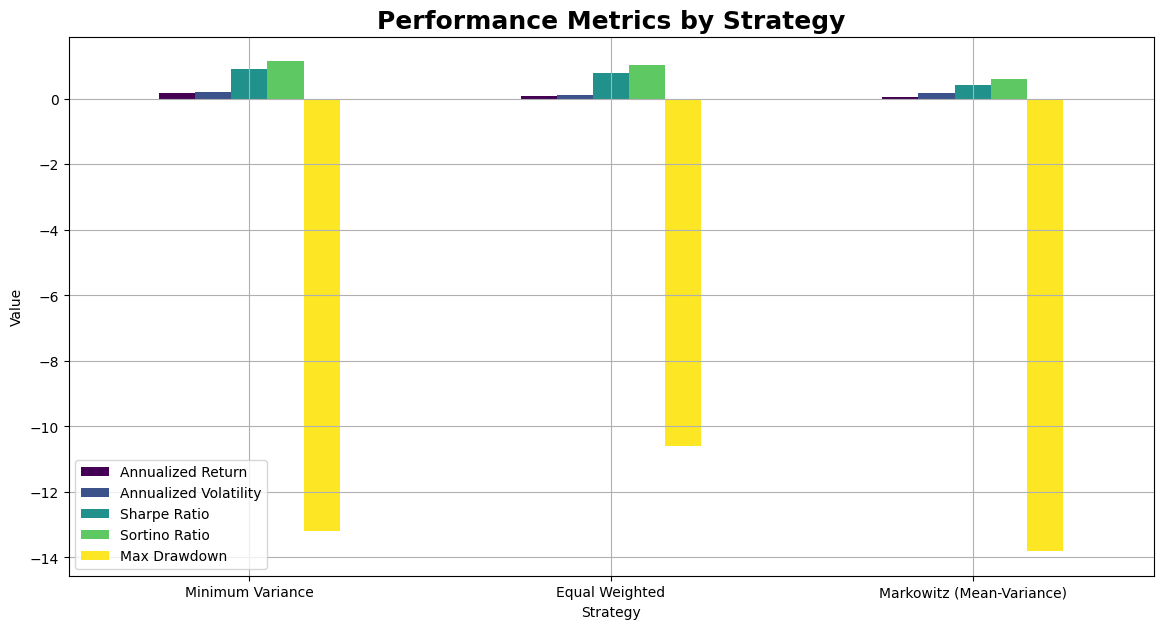

Annualized Return Annualized Volatility \

Minimum Variance 0.186117 0.203196

Equal Weighted 0.091404 0.116153

Markowitz (Mean-Variance) 0.071822 0.169583

Sharpe Ratio Sortino Ratio Max Drawdown

Minimum Variance 0.915950 1.149967 -13.204538

Equal Weighted 0.786927 1.033226 -10.613445

Markowitz (Mean-Variance) 0.423524 0.605596 -13.811130

Plot performance metrics#

performance_df.plot(kind="bar", figsize=(14, 7), colormap="viridis")

plt.title("Performance Metrics by Strategy", fontsize=18, fontweight="bold")

plt.xlabel("Strategy")

plt.ylabel("Value")

plt.xticks(rotation=0)

plt.grid(True)

plt.show()