Pairs Trading Strategy Optimization in Python with AMPL#

Description: Optimize pairs trading strategy by optimizing entry and exit thresholds for each pair based on training data. This approach uses interpolation to find optimal parameters within the range tested.

Tags: finance, pairs-trading

Notebook author: Mukeshwaran Baskaran <mukesh96official@gmail.com>

Introduction#

This notebook helps you understand and improve a trading strategy called “pairs trading.” It uses historical stock data to find the best times to buy and sell pairs of stocks. The goal is to make money by identifying when the prices of these stocks move away from their usual relationship and then return to normal. The notebook tests different trading parameters to find the ones that work best. It then uses AMPL to optimise these parameters, making the trading strategy more effective.

# Install dependencies

%pip install amplpy yfinance matplotlib pandas numpy -q

# Google Colab & Kaggle integration

from amplpy import AMPL, ampl_notebook

ampl = ampl_notebook(

modules=["knitro"], # modules to install

license_uuid="default", # license to use

) # instantiate AMPL object and register magics

# Import libraries

import yfinance as yf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import os

import time

import logging

import matplotlib.colors as mcolors

# Define a list of distinct colors

colors = list(mcolors.TABLEAU_COLORS) # Using Tableau colors for distinctiveness

# Define stock pairs and fetch data

STOCK_PAIRS = [

("AAPL", "MSFT"), # Apple & Microsoft

("GOOGL", "META"), # Google & Meta

("XOM", "CVX"), # Exxon Mobil & Chevron

("AMZN", "WMT"), # Amazon & Walmart

("PG", "UL"), # Procter & Gamble & Unilever

("KO", "PEP"), # Coca-Cola & PepsiCo

("INTC", "AMD"), # Intel & Advanced Micro Devices

("TSLA", "NIO"), # Tesla & NIO

("BMY", "LLY"), # Bristol-Myers Squibb & Eli Lilly

("V", "MA"), # Visa & Mastercard

]

START_DATE = "2015-01-01"

END_DATE = "2025-01-01"

# Configure logging

logging.basicConfig(

level=logging.INFO, format="%(asctime)s - %(levelname)s - %(message)s"

)

Implementation#

Download historical data for stock pairs#

def fetch_stock_data(pairs, start_date, end_date, retries=3):

"""Fetch historical data for given stock pairs with retry mechanism."""

data = {}

for pair in pairs:

ticker1, ticker2 = pair

attempt = 0

while attempt < retries:

try:

data[pair] = yf.download(

[ticker1, ticker2], start=start_date, end=end_date

)["Close"]

logging.info(f"Successfully fetched data for {ticker1}, {ticker2}")

break # Successfully fetched data, break out of retry loop

except Exception as e:

logging.error(f"Error fetching data for {ticker1}, {ticker2}: {e}")

attempt += 1

if attempt < retries:

logging.info(f"Retrying... ({attempt}/{retries})")

time.sleep(5) # Wait before retrying

else:

logging.error(

f"Failed to fetch data after {retries} attempts for {ticker1}, {ticker2}"

)

return data

Calculate spread and z-score#

def calculate_spread_zscore(data, lookback=30):

"""Calculate spread and z-score for each pair."""

spreads = {}

z_scores = {}

for pair in data:

ticker1, ticker2 = pair

spread = data[pair][ticker1] - data[pair][ticker2]

spread_mean = spread.rolling(window=lookback).mean()

spread_std = spread.rolling(window=lookback).std()

z_score = (spread - spread_mean) / spread_std

spreads[pair] = spread

z_scores[pair] = z_score

return spreads, z_scores

Backtest pairs trading strategy with pair-specific parameters#

def backtest_pairs_trading(data, z_scores, pair_params):

"""

Backtest a pairs trading strategy using pair-specific parameters.

Args:

data: Dictionary of price data

z_scores: Dictionary of z-scores

pair_params: Dictionary mapping pair strings to (entry_threshold, exit_threshold) tuples

"""

results = {}

for pair in data:

ticker1, ticker2 = pair

pair_key = f"{ticker1}_{ticker2}"

# Get pair-specific parameters or use defaults

entry_threshold, exit_threshold = pair_params.get(pair_key, (1.0, 0.5))

z_score = z_scores[pair]

positions = pd.Series(0, index=z_score.index)

returns = pd.Series(0.0, index=z_score.index)

# Generate trading signals

long_entry = z_score < -entry_threshold

short_entry = z_score > entry_threshold

long_exit = z_score > -exit_threshold

short_exit = z_score < exit_threshold

# Simulate trades

position = 0

for i in range(1, len(z_score)):

if long_entry.iloc[i] and position <= 0:

position = 1 # Go long

elif short_entry.iloc[i] and position >= 0:

position = -1 # Go short

elif (long_exit.iloc[i] and position == 1) or (

short_exit.iloc[i] and position == -1

):

position = 0 # Exit position

positions.iloc[i] = position

returns.iloc[i] = (

position

* (data[pair][ticker1].iloc[i] - data[pair][ticker1].iloc[i - 1])

/ data[pair][ticker1].iloc[i - 1]

)

# Calculate drawdown

cumulative_returns = returns.cumsum()

drawdown = cumulative_returns - cumulative_returns.cummax()

# Store results

results[pair_key] = {

"positions": positions,

"returns": returns,

"cumulative_returns": cumulative_returns,

"drawdown": drawdown,

"sharpe_ratio": (

(returns.mean() / returns.std()) * np.sqrt(252)

if returns.std() > 0

else 0

),

}

return results

Create training data for AMPL optimization#

def create_training_data(stock_data, z_scores, pairs, num_samples=20):

"""

Generate training data for AMPL by running backtests with different parameters.

Args:

stock_data: Dictionary of price data

z_scores: Dictionary of z-scores

pairs: List of stock pairs

num_samples: Number of parameter combinations to test

Returns:

Dictionary with pairs as keys and lists of (entry, exit, sharpe) tuples as values

"""

# Define parameter ranges

entry_range = np.linspace(0.5, 2.5, int(np.sqrt(num_samples)))

exit_range = np.linspace(0.1, 1.5, int(np.sqrt(num_samples)))

training_data = {}

for pair in pairs:

ticker1, ticker2 = pair

pair_key = f"{ticker1}_{ticker2}"

training_data[pair_key] = []

logging.info(f"Generating training data for {pair_key}...")

# Generate parameter combinations where entry >= exit

valid_combinations = [(e, x) for e in entry_range for x in exit_range if e >= x]

for entry, exit in valid_combinations:

# Test this parameter combination

test_params = {pair_key: (entry, exit)}

results = backtest_pairs_trading(

{pair: stock_data[pair]}, {pair: z_scores[pair]}, test_params

)

sharpe = results[pair_key]["sharpe_ratio"]

# Store the parameter combination and resulting Sharpe ratio

training_data[pair_key].append((entry, exit, sharpe))

return training_data

Optimize parameters for each pair independently#

def optimize_pair_parameters(stock_data, z_scores):

"""

Optimize parameters for each pair individually using grid search approach.

Returns a dictionary with optimal parameters for each pair.

"""

# Define search grid - can be adjusted for finer/broader search

entry_thresholds = np.linspace(0.5, 2.5, 5) # [0.5, 1.0, 1.5, 2.0, 2.5]

exit_thresholds = np.linspace(0.1, 1.5, 5) # [0.1, 0.4, 0.7, 1.0, 1.3]

optimal_params = {}

for pair in stock_data:

ticker1, ticker2 = pair

pair_key = f"{ticker1}_{ticker2}"

best_sharpe = -np.inf

best_params = (1.0, 0.5) # Default

logging.info(f"Optimizing parameters for pair: {pair_key}")

for entry in entry_thresholds:

for exit in exit_thresholds:

# Skip invalid combinations (entry must be >= exit)

if entry < exit:

continue

# Test this parameter combination

test_params = {pair_key: (entry, exit)}

results = backtest_pairs_trading(

{pair: stock_data[pair]}, {pair: z_scores[pair]}, test_params

)

sharpe = results[pair_key]["sharpe_ratio"]

if sharpe > best_sharpe:

best_sharpe = sharpe

best_params = (entry, exit)

logging.info(

f"Optimal parameters for {pair_key}: Entry={best_params[0]:.2f}, Exit={best_params[1]:.2f}, Sharpe={best_sharpe:.4f}"

)

optimal_params[pair_key] = best_params

return optimal_params

Optimize parameters using AMPL for each pair#

def optimize_with_ampl(training_data):

"""

Use AMPL to optimize entry and exit thresholds for each pair based on training data.

This approach uses interpolation to find optimal parameters within the range tested.

"""

optimal_params = {}

for pair_key in training_data:

logging.info(f"Optimizing parameters for {pair_key} using AMPL...")

# Extract training data for this pair

pair_data = training_data[pair_key]

entry_values = [p[0] for p in pair_data]

exit_values = [p[1] for p in pair_data]

sharpe_values = [p[2] for p in pair_data]

ampl = AMPL()

# Define AMPL model for interpolation and optimization

ampl.eval(

r"""

# Sets for parameter combinations

set SAMPLES;

# Parameters for each sample

param entry_threshold {SAMPLES};

param exit_threshold {SAMPLES};

param sharpe_ratio {SAMPLES};

# Decision variables for optimal thresholds

var opt_entry >= 0.5, <= 2.5;

var opt_exit >= 0.1, <= 1.5;

# RBF kernel function for interpolation (Gaussian)

param sigma := 0.3; # Width parameter for RBF kernel

# RBF kernel function: exp(-||x - y||^2 / (2*sigma^2))

var rbf_kernel{s in SAMPLES} = exp(-((opt_entry - entry_threshold[s])^2 + (opt_exit - exit_threshold[s])^2) / (2*sigma^2));

# Interpolated objective function using RBF kernel

maximize predicted_sharpe:

sum {s in SAMPLES} sharpe_ratio[s] * rbf_kernel[s] /

sum {t in SAMPLES} rbf_kernel[t];

# Constraint: entry threshold must be greater than or equal to exit threshold

subject to threshold_constraint:

opt_entry >= opt_exit;

"""

)

# Set data in AMPL

ampl.set["SAMPLES"] = list(range(len(pair_data)))

ampl.param["entry_threshold"] = {

i: pair_data[i][0] for i in range(len(pair_data))

}

ampl.param["exit_threshold"] = {

i: pair_data[i][1] for i in range(len(pair_data))

}

ampl.param["sharpe_ratio"] = {i: pair_data[i][2] for i in range(len(pair_data))}

# Solve the optimization problem

try:

ampl.solve(solver="knitro", knitro_options="outlev=1")

assert ampl.solve_result == "solved", ampl.solve_result

# Extract optimized parameters

opt_entry = ampl.var["opt_entry"].value()

opt_exit = ampl.var["opt_exit"].value()

predicted_sharpe = ampl.obj["predicted_sharpe"].value()

logging.info(

f"AMPL optimization for {pair_key}: Entry={opt_entry:.2f}, Exit={opt_exit:.2f}, Predicted Sharpe={predicted_sharpe:.4f}"

)

optimal_params[pair_key] = (opt_entry, opt_exit)

except Exception as e:

logging.error(f"AMPL optimization failed for {pair_key}: {e}")

# Fallback to best sample if optimization fails

best_idx = np.argmax(sharpe_values)

optimal_params[pair_key] = (entry_values[best_idx], exit_values[best_idx])

logging.info(

f"Falling back to best sample: Entry={entry_values[best_idx]:.2f}, Exit={exit_values[best_idx]:.2f}"

)

return optimal_params

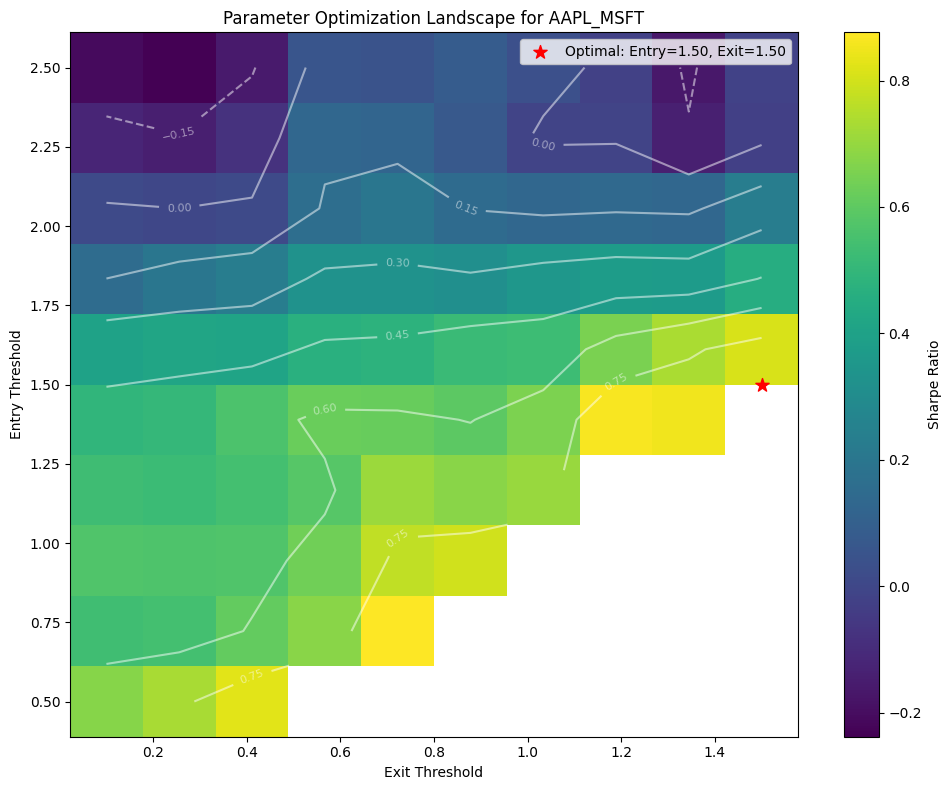

Plot parameter heatmap with AMPL solution#

def plot_parameter_heatmap(training_data, optimal_params, pair_key):

"""Plot heatmap of Sharpe ratios with AMPL's optimal solution."""

# Extract data for visualization

entry_values = [p[0] for p in training_data[pair_key]]

exit_values = [p[1] for p in training_data[pair_key]]

sharpe_values = [p[2] for p in training_data[pair_key]]

# Create a grid for the heatmap

entry_grid = np.linspace(min(entry_values), max(entry_values), 50)

exit_grid = np.linspace(min(exit_values), max(exit_values), 50)

# Create mesh grid

X, Y = np.meshgrid(exit_grid, entry_grid)

Z = np.zeros(X.shape)

# Fill Z with interpolated values using RBF kernel

sigma = 0.3 # Same as in AMPL model

for i in range(Z.shape[0]):

for j in range(Z.shape[1]):

if entry_grid[i] < exit_grid[j]: # Skip invalid regions

Z[i, j] = np.nan

continue

# RBF interpolation

weights = np.exp(

-(

(entry_grid[i] - np.array(entry_values)) ** 2

+ (exit_grid[j] - np.array(exit_values)) ** 2

)

/ (2 * sigma**2)

)

if np.sum(weights) > 0:

Z[i, j] = np.sum(weights * np.array(sharpe_values)) / np.sum(weights)

else:

Z[i, j] = np.nan

# Create plot

plt.figure(figsize=(10, 8))

# Plot heatmap

cmap = plt.cm.viridis

cmap.set_bad("white", 1.0)

heatmap = plt.pcolormesh(X, Y, Z, cmap=cmap, shading="auto")

plt.colorbar(heatmap, label="Interpolated Sharpe Ratio")

plt.title(f"Parameter Optimization Landscape for {pair_key}")

plt.xlabel("Exit Threshold")

plt.ylabel("Entry Threshold")

# Add contour lines

contour = plt.contour(X, Y, Z, colors="white", alpha=0.5)

plt.clabel(contour, inline=True, fontsize=8)

# Plot training data points

plt.scatter(

exit_values,

entry_values,

c=sharpe_values,

cmap="viridis",

s=50,

edgecolor="black",

label="Training Samples",

)

# Mark the AMPL optimal solution

opt_entry, opt_exit = optimal_params[pair_key]

plt.scatter(

[opt_exit],

[opt_entry],

color="red",

s=200,

marker="*",

label=f"AMPL Optimal: Entry={opt_entry:.2f}, Exit={opt_exit:.2f}",

)

# Diagonal line showing the constraint boundary

diag_x = np.linspace(min(exit_grid), max(exit_grid), 100)

plt.plot(diag_x, diag_x, "r--", alpha=0.7, label="Constraint: Entry ≥ Exit")

plt.legend()

plt.tight_layout()

plt.show()

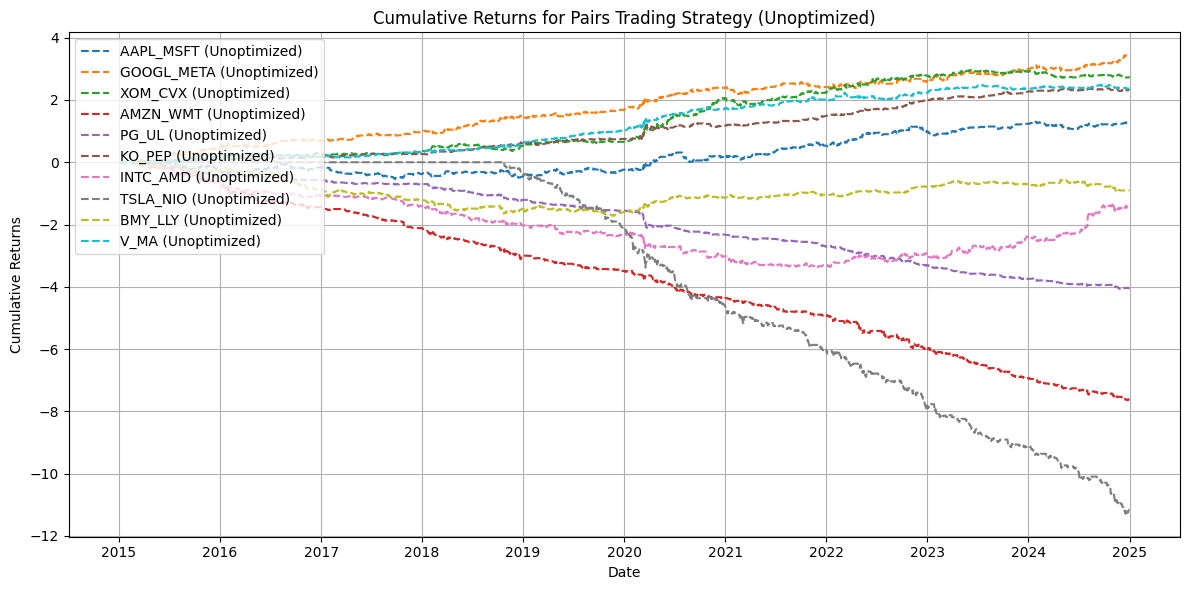

Plot cumulative returns for unoptimized strategy#

def plot_cumulative_returns_unoptimized(unoptimized_results):

"""Plot cumulative returns for unoptimized strategy."""

plt.figure(figsize=(12, 6))

# Plot unoptimized cumulative returns with different colors

for i, pair in enumerate(unoptimized_results):

plt.plot(

unoptimized_results[pair]["cumulative_returns"],

label=f"{pair} (Unoptimized)",

linestyle="--",

color=colors[i % len(colors)],

)

plt.title("Cumulative Returns for Pairs Trading Strategy (Unoptimized)")

plt.xlabel("Date")

plt.ylabel("Cumulative Returns")

plt.legend(loc="upper left")

plt.grid(True)

plt.tight_layout()

plt.show()

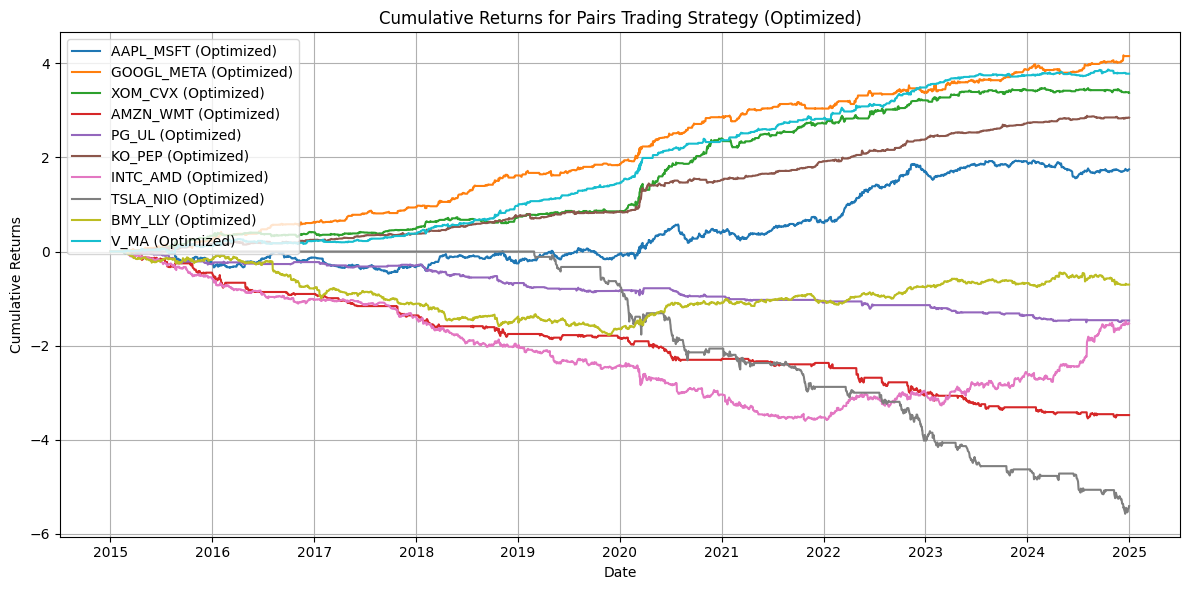

Plot cumulative returns for optimized strategy#

def plot_cumulative_returns_optimized(optimized_results):

"""Plot cumulative returns for optimized strategy."""

plt.figure(figsize=(12, 6))

# Plot optimized cumulative returns with different colors

for i, pair in enumerate(optimized_results):

plt.plot(

optimized_results[pair]["cumulative_returns"],

label=f"{pair} (Optimized)",

linestyle="-",

color=colors[i % len(colors)],

)

plt.title("Cumulative Returns for Pairs Trading Strategy (Optimized)")

plt.xlabel("Date")

plt.ylabel("Cumulative Returns")

plt.legend(loc="upper left")

plt.grid(True)

plt.tight_layout()

plt.show()

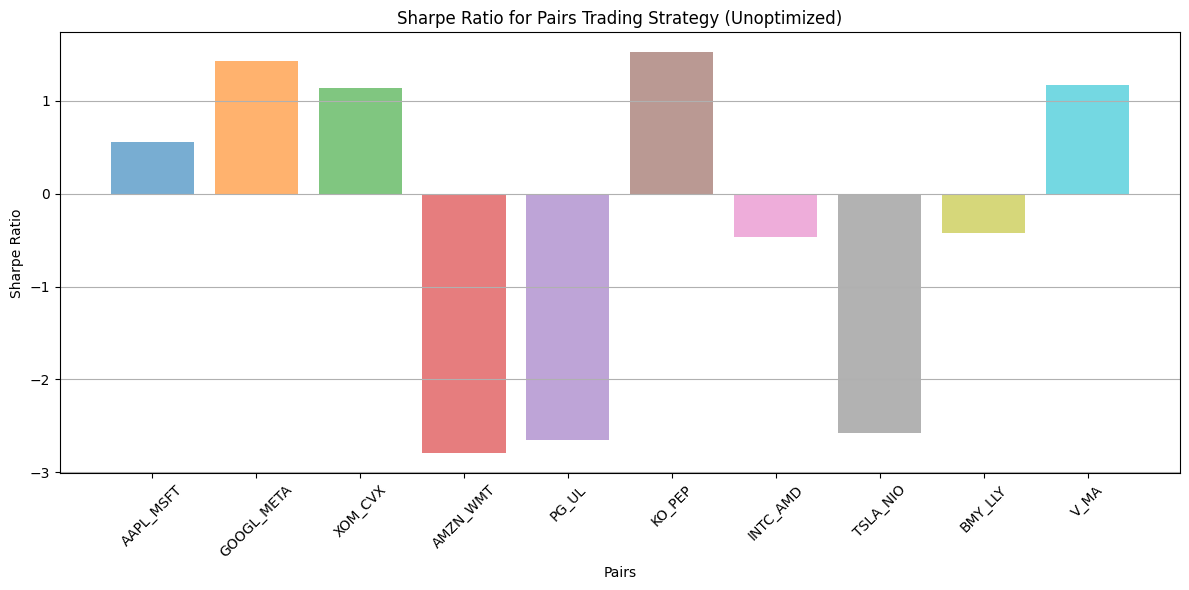

Plot Sharpe ratio for unoptimized strategy#

def plot_sharpe_ratio_unoptimized(unoptimized_results):

"""Plot Sharpe ratio for unoptimized strategy."""

sharpe_ratios_before = {

pair: unoptimized_results[pair]["sharpe_ratio"] for pair in unoptimized_results

}

plt.figure(figsize=(12, 6))

# Plot Sharpe ratios for unoptimized with different colors

for i, pair in enumerate(sharpe_ratios_before):

plt.bar(

i,

sharpe_ratios_before[pair],

label=f"{pair}",

alpha=0.6,

color=colors[i % len(colors)],

)

plt.title("Sharpe Ratio for Pairs Trading Strategy (Unoptimized)")

plt.xlabel("Pairs")

plt.ylabel("Sharpe Ratio")

plt.xticks(

range(len(sharpe_ratios_before)), sharpe_ratios_before.keys(), rotation=45

)

plt.tight_layout()

plt.grid(True, axis="y")

plt.show()

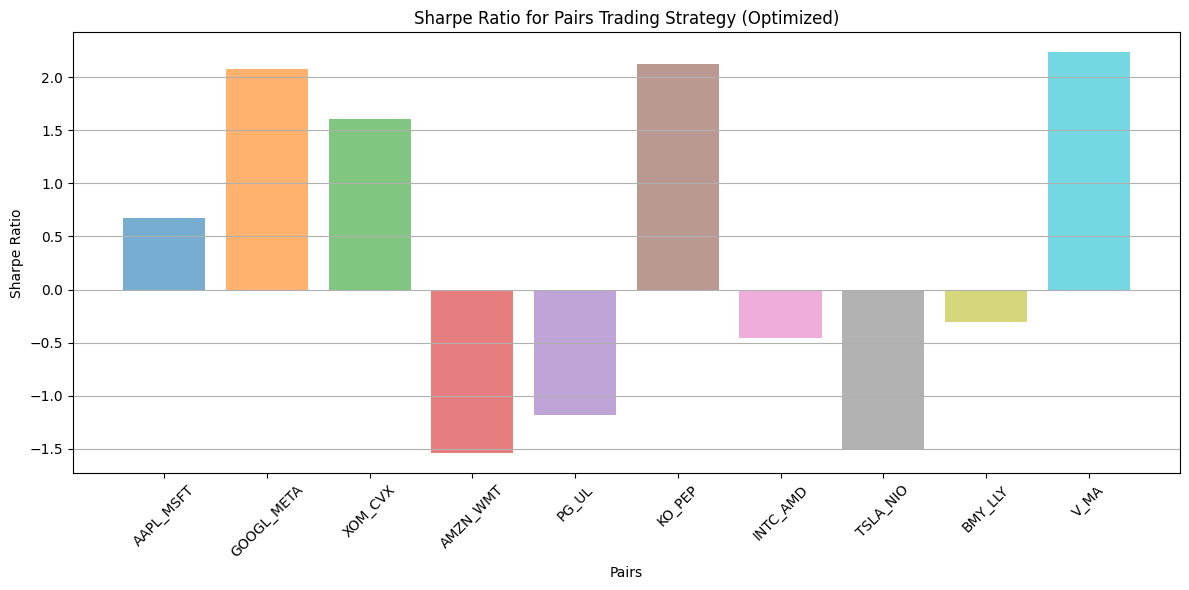

Plot Sharpe ratio for optimized strategy#

def plot_sharpe_ratio_optimized(optimized_results):

"""Plot Sharpe ratio for optimized strategy."""

sharpe_ratios_after = {

pair: optimized_results[pair]["sharpe_ratio"] for pair in optimized_results

}

plt.figure(figsize=(12, 6))

# Plot Sharpe ratios for optimized with different colors

for i, pair in enumerate(sharpe_ratios_after):

plt.bar(

i,

sharpe_ratios_after[pair],

label=f"{pair}",

alpha=0.6,

color=colors[i % len(colors)],

)

plt.title("Sharpe Ratio for Pairs Trading Strategy (Optimized)")

plt.xlabel("Pairs")

plt.ylabel("Sharpe Ratio")

plt.xticks(range(len(sharpe_ratios_after)), sharpe_ratios_after.keys(), rotation=45)

plt.tight_layout()

plt.grid(True, axis="y")

plt.show()

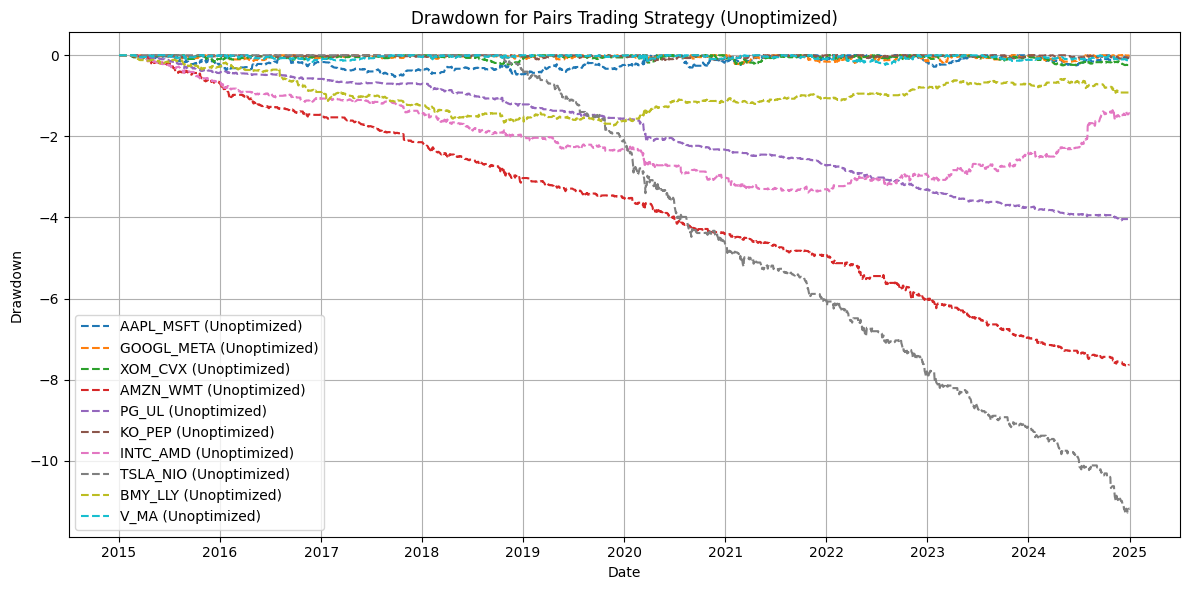

Plot drawdown for unoptimized strategy#

def plot_drawdown_unoptimized(unoptimized_results):

"""Plot drawdown for unoptimized strategy."""

plt.figure(figsize=(12, 6))

# Plot unoptimized drawdowns with different colors

for i, pair in enumerate(unoptimized_results):

plt.plot(

unoptimized_results[pair]["drawdown"],

label=f"{pair} (Unoptimized)",

linestyle="--",

color=colors[i % len(colors)],

)

plt.title("Drawdown for Pairs Trading Strategy (Unoptimized)")

plt.xlabel("Date")

plt.ylabel("Drawdown")

plt.legend(loc="lower left")

plt.grid(True)

plt.tight_layout()

plt.show()

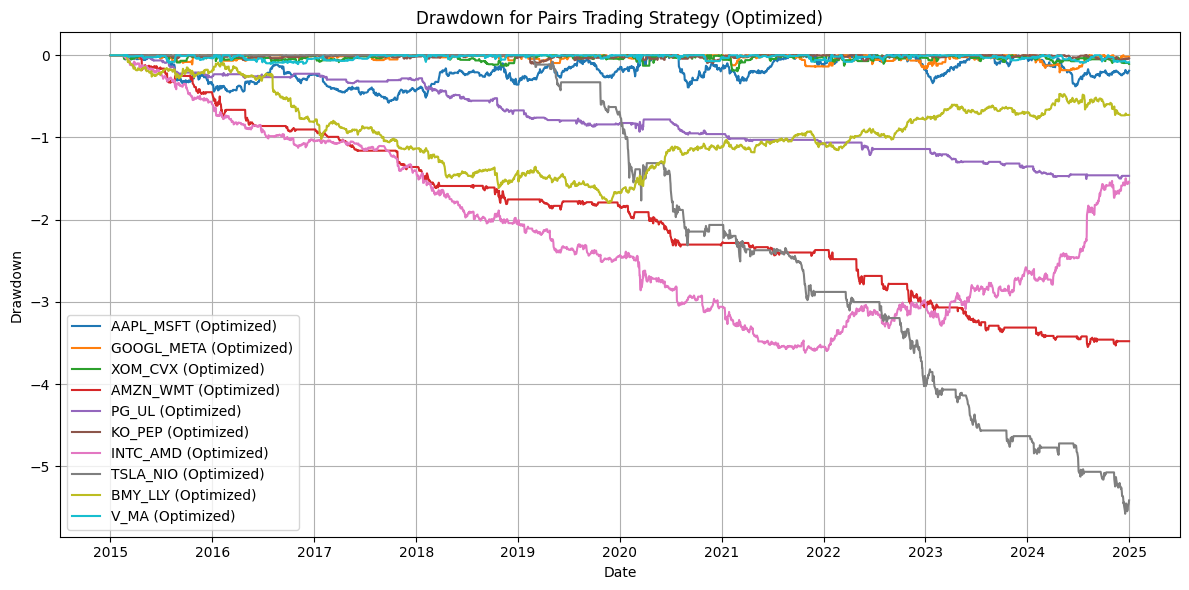

Plot drawdown for optimized strategy#

def plot_drawdown_optimized(optimized_results):

"""Plot drawdown for optimized strategy."""

plt.figure(figsize=(12, 6))

# Plot optimized drawdowns with different colors

for i, pair in enumerate(optimized_results):

plt.plot(

optimized_results[pair]["drawdown"],

label=f"{pair} (Optimized)",

linestyle="-",

color=colors[i % len(colors)],

)

plt.title("Drawdown for Pairs Trading Strategy (Optimized)")

plt.xlabel("Date")

plt.ylabel("Drawdown")

plt.legend(loc="lower left")

plt.grid(True)

plt.tight_layout()

plt.show()

Plot comparison of unoptimized vs optimized Sharpe ratios#

def plot_sharpe_comparison(unoptimized_results, optimized_results):

"""Plot comparison of Sharpe ratios before and after optimization."""

pairs = sorted(unoptimized_results.keys())

sharpe_before = [unoptimized_results[p]["sharpe_ratio"] for p in pairs]

sharpe_after = [optimized_results[p]["sharpe_ratio"] for p in pairs]

x = np.arange(len(pairs))

width = 0.35

fig, ax = plt.subplots(figsize=(12, 6))

rects1 = ax.bar(x - width / 2, sharpe_before, width, label="Unoptimized", alpha=0.7)

rects2 = ax.bar(x + width / 2, sharpe_after, width, label="Optimized", alpha=0.7)

ax.set_title("Sharpe Ratio Comparison: Unoptimized vs. Optimized")

ax.set_xlabel("Pairs")

ax.set_ylabel("Sharpe Ratio")

ax.set_xticks(x)

ax.set_xticklabels(pairs, rotation=45)

ax.legend()

ax.bar_label(rects1, padding=3, fmt="%.2f")

ax.bar_label(rects2, padding=3, fmt="%.2f")

fig.tight_layout()

plt.grid(True, axis="y")

plt.show()

Plot parameter heatmap to visualize the optimization landscape for a specific pair#

def plot_parameter_heatmap(stock_data, z_scores, pair_index=0):

"""Plot heatmap of Sharpe ratios for different parameter combinations."""

# Select a pair for visualization

pair = list(stock_data.keys())[pair_index]

ticker1, ticker2 = pair

pair_key = f"{ticker1}_{ticker2}"

# Define search grid with finer resolution for visualization

entry_thresholds = np.linspace(0.5, 2.5, 10)

exit_thresholds = np.linspace(0.1, 1.5, 10)

# Create empty grid for heatmap data

sharpe_grid = np.zeros((len(entry_thresholds), len(exit_thresholds)))

sharpe_grid[:] = np.nan # Fill with NaN for invalid combinations

# Calculate Sharpe ratios for parameter combinations

for i, entry in enumerate(entry_thresholds):

for j, exit in enumerate(exit_thresholds):

# Skip invalid combinations (entry must be >= exit)

if entry < exit:

continue

# Test this parameter combination

test_params = {pair_key: (entry, exit)}

results = backtest_pairs_trading(

{pair: stock_data[pair]}, {pair: z_scores[pair]}, test_params

)

sharpe = results[pair_key]["sharpe_ratio"]

sharpe_grid[i, j] = sharpe

# Create heatmap

plt.figure(figsize=(10, 8))

heatmap = plt.pcolormesh(

exit_thresholds, entry_thresholds, sharpe_grid, cmap="viridis", shading="auto"

)

plt.colorbar(heatmap, label="Sharpe Ratio")

plt.title(f"Parameter Optimization Landscape for {pair_key}")

plt.xlabel("Exit Threshold")

plt.ylabel("Entry Threshold")

# Add contour lines

contour = plt.contour(

exit_thresholds, entry_thresholds, sharpe_grid, colors="white", alpha=0.5

)

plt.clabel(contour, inline=True, fontsize=8)

# Mark the optimal point

optimal_params = optimize_pair_parameters(

{pair: stock_data[pair]}, {pair: z_scores[pair]}

)

opt_entry, opt_exit = optimal_params[pair_key]

plt.scatter(

[opt_exit],

[opt_entry],

color="red",

s=100,

marker="*",

label=f"Optimal: Entry={opt_entry:.2f}, Exit={opt_exit:.2f}",

)

plt.legend()

plt.tight_layout()

plt.show()

Print optimization summary showing parameters and performance#

def print_optimization_summary(

optimized_params, unoptimized_results, optimized_results

):

"""Print a summary of the optimization results."""

print("\n" + "=" * 80)

print("PAIRS TRADING STRATEGY OPTIMIZATION SUMMARY")

print("=" * 80)

print("\nOptimized Parameters:")

print("-" * 50)

print(f"{'Pair':<15} {'Entry Threshold':<20} {'Exit Threshold':<20}")

print("-" * 50)

for pair_key in sorted(optimized_params.keys()):

entry, exit = optimized_params[pair_key]

print(f"{pair_key:<15} {entry:<20.2f} {exit:<20.2f}")

print("\nPerformance Comparison:")

print("-" * 80)

print(

f"{'Pair':<15} {'Unopt. Sharpe':<15} {'Opt. Sharpe':<15} {'Improvement':<15} {'% Change':<15}"

)

print("-" * 80)

total_before = 0

total_after = 0

for pair_key in sorted(unoptimized_results.keys()):

before = unoptimized_results[pair_key]["sharpe_ratio"]

after = optimized_results[pair_key]["sharpe_ratio"]

improvement = after - before

percent_change = (

(improvement / abs(before)) * 100 if before != 0 else float("inf")

)

print(

f"{pair_key:<15} {before:<15.4f} {after:<15.4f} {improvement:<+15.4f} {percent_change:<+15.2f}%"

)

total_before += before

total_after += after

total_improvement = total_after - total_before

total_percent = (

(total_improvement / abs(total_before)) * 100

if total_before != 0

else float("inf")

)

print("-" * 80)

print(

f"{'TOTAL':<15} {total_before:<15.4f} {total_after:<15.4f} {total_improvement:<+15.4f} {total_percent:<+15.2f}%"

)

print("=" * 80)

Compare all metrics between optimized and unoptimized strategies#

def compare_strategies(unoptimized_results, optimized_results):

"""Calculate and compare key metrics between strategies."""

metrics = {}

for strategy, results in [

("Unoptimized", unoptimized_results),

("Optimized", optimized_results),

]:

# Calculate portfolio-level metrics

all_returns = pd.DataFrame({pair: results[pair]["returns"] for pair in results})

portfolio_returns = all_returns.mean(axis=1) # Equal-weighted portfolio

cum_returns = portfolio_returns.cumsum()

drawdown = cum_returns - cum_returns.cummax()

# Calculate metrics

metrics[strategy] = {

"Total Return": cum_returns.iloc[-1],

"Annualized Return": portfolio_returns.mean() * 252,

"Annualized Volatility": portfolio_returns.std() * np.sqrt(252),

"Sharpe Ratio": (portfolio_returns.mean() / portfolio_returns.std())

* np.sqrt(252),

"Max Drawdown": drawdown.min(),

"Calmar Ratio": (

(portfolio_returns.mean() * 252) / abs(drawdown.min())

if drawdown.min() < 0

else np.inf

),

"Winning Pairs": sum(

1 for p in results if results[p]["cumulative_returns"].iloc[-1] > 0

),

"Total Pairs": len(results),

}

# Create comparison DataFrame

comparison = pd.DataFrame({k: v for k, v in metrics.items()})

# Calculate improvement

improvement = comparison["Optimized"] - comparison["Unoptimized"]

percent_change = (improvement / comparison["Unoptimized"].abs()) * 100

comparison["Improvement"] = improvement

comparison["% Change"] = percent_change

return comparison

Plot portfolio returns comparison#

def plot_portfolio_comparison(unoptimized_results, optimized_results):

"""Plot comparison of portfolio returns."""

# Calculate portfolio returns for each strategy

unopt_returns = pd.DataFrame(

{pair: unoptimized_results[pair]["returns"] for pair in unoptimized_results}

)

opt_returns = pd.DataFrame(

{pair: optimized_results[pair]["returns"] for pair in optimized_results}

)

unopt_portfolio = unopt_returns.mean(axis=1).cumsum()

opt_portfolio = opt_returns.mean(axis=1).cumsum()

# Plot comparison

plt.figure(figsize=(12, 6))

plt.plot(

unopt_portfolio,

label="Unoptimized Portfolio",

linestyle="--",

color="blue",

alpha=0.7,

)

plt.plot(opt_portfolio, label="Optimized Portfolio", linestyle="-", color="green")

plt.title("Equal-Weighted Portfolio Performance: Unoptimized vs. Optimized")

plt.xlabel("Date")

plt.ylabel("Cumulative Returns")

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

Execution#

Fetch data#

logging.info("Fetching stock data...")

stock_data = fetch_stock_data(STOCK_PAIRS, START_DATE, END_DATE)

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

[*********************100%***********************] 2 of 2 completed

Calculate spread and z-score#

logging.info("Calculating spreads and z-scores...")

spreads, z_scores = calculate_spread_zscore(stock_data)

Default parameters for unoptimized strategy#

default_entry_threshold = 1.0

default_exit_threshold = 0.5

default_params = {

f"{p[0]}_{p[1]}": (default_entry_threshold, default_exit_threshold)

for p in stock_data

}

Backtest with default parameters#

logging.info("Running backtest with default parameters...")

unoptimized_results = backtest_pairs_trading(stock_data, z_scores, default_params)

Optimize parameters for each pair#

logging.info("Starting parameter optimization for each pair...")

# optimized_params = optimize_pair_parameters(stock_data, z_scores)

training_data = create_training_data(stock_data, z_scores, STOCK_PAIRS, num_samples=20)

optimized_params = optimize_with_ampl(training_data)

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 6.60226460566116e-01

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 1.12e-12 / 1.12e-12

# of iterations = 6

# of CG iterations = 2

# of function evaluations = 8

# of gradient evaluations = 8

# of Hessian evaluations = 6

Total program time (secs) = 0.01247 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00013

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective 0.6602264606; feasibility error 0

6 iterations; 8 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 1.72882455097880e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 4.27e-10 / 4.27e-10

# of iterations = 5

# of CG iterations = 1

# of function evaluations = 7

# of gradient evaluations = 7

# of Hessian evaluations = 5

Total program time (secs) = 0.01283 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00009

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective 1.728824551; feasibility error 0

5 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 1.22894685859887e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 1.83e-07 / 1.83e-07

# of iterations = 5

# of CG iterations = 1

# of function evaluations = 7

# of gradient evaluations = 7

# of Hessian evaluations = 5

Total program time (secs) = 0.01388 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00007

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective 1.228946859; feasibility error 0

5 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = -1.58414965720312e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 1.11e-08 / 1.11e-08

# of iterations = 5

# of CG iterations = 1

# of function evaluations = 7

# of gradient evaluations = 7

# of Hessian evaluations = 5

Total program time (secs) = 0.01037 ( 0.001 CPU time)

Time spent in evaluations (secs) = 0.00007

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective -1.584149657; feasibility error 0

5 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = -1.27901930071936e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 8.34e-11 / 8.34e-11

# of iterations = 6

# of CG iterations = 1

# of function evaluations = 8

# of gradient evaluations = 8

# of Hessian evaluations = 6

Total program time (secs) = 0.00437 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00008

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective -1.279019301; feasibility error 0

6 iterations; 8 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 1.88225833653188e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 7.80e-08 / 7.80e-08

# of iterations = 4

# of CG iterations = 0

# of function evaluations = 7

# of gradient evaluations = 6

# of Hessian evaluations = 4

Total program time (secs) = 0.00400 ( 0.001 CPU time)

Time spent in evaluations (secs) = 0.00007

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective 1.882258337; feasibility error 0

4 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = -4.59642470584898e-01

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 3.86e-10 / 3.86e-10

# of iterations = 6

# of CG iterations = 0

# of function evaluations = 8

# of gradient evaluations = 8

# of Hessian evaluations = 6

Total program time (secs) = 0.00650 ( 0.001 CPU time)

Time spent in evaluations (secs) = 0.00008

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective -0.4596424706; feasibility error 0

6 iterations; 8 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = -1.55512899004693e+00

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 1.25e-11 / 1.25e-11

# of iterations = 6

# of CG iterations = 1

# of function evaluations = 8

# of gradient evaluations = 8

# of Hessian evaluations = 6

Total program time (secs) = 0.01100 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00008

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective -1.55512899; feasibility error 0

6 iterations; 8 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = -3.23863028566155e-01

Final feasibility error (abs / rel) = 0.00e+00 / 0.00e+00

Final optimality error (abs / rel) = 7.62e-07 / 7.62e-07

# of iterations = 5

# of CG iterations = 0

# of function evaluations = 7

# of gradient evaluations = 7

# of Hessian evaluations = 5

Total program time (secs) = 0.00966 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00011

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective -0.3238630286; feasibility error 0

5 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Artelys Knitro 14.2.0: outlev=1

=======================================

Commercial License

Artelys Knitro 14.2.0

=======================================

Knitro presolve eliminated 0 variables and 0 constraints.

concurrent_evals 0

datacheck 0

findiff_numthreads 1

hessian_no_f 1

hessopt 1

outlev 1

The problem is linearly constrained.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 2 ( 2)

bounded below only: 0 ( 0)

bounded above only: 0 ( 0)

bounded below and above: 2 ( 2)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 1 ( 1)

linear equalities: 0 ( 0)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 1)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of nonzeros in Jacobian: 2 ( 2)

Number of nonzeros in Hessian: 3 ( 3)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 1.66971838341197e+00

Final feasibility error (abs / rel) = 4.07e-11 / 4.07e-11

Final optimality error (abs / rel) = 3.43e-10 / 3.43e-10

# of iterations = 5

# of CG iterations = 1

# of function evaluations = 7

# of gradient evaluations = 7

# of Hessian evaluations = 5

Total program time (secs) = 0.00725 ( 0.001 CPU time)

Time spent in evaluations (secs) = 0.00007

===============================================================================

Knitro 14.2.0: Locally optimal or satisfactory solution.

objective 1.669718383; feasibility error 4.07e-11

5 iterations; 7 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

Backtest with optimized parameters#

logging.info("Running backtest with optimized parameters...")

optimized_results = backtest_pairs_trading(stock_data, z_scores, optimized_params)

Print optimization summary#

print_optimization_summary(optimized_params, unoptimized_results, optimized_results)

================================================================================

PAIRS TRADING STRATEGY OPTIMIZATION SUMMARY

================================================================================

Optimized Parameters:

--------------------------------------------------

Pair Entry Threshold Exit Threshold

--------------------------------------------------

AAPL_MSFT 0.50 0.10

AMZN_WMT 2.50 0.10

BMY_LLY 0.50 0.10

GOOGL_META 1.17 1.17

INTC_AMD 0.50 0.10

KO_PEP 1.13 1.13

PG_UL 2.50 0.10

TSLA_NIO 2.50 0.10

V_MA 1.16 1.16

XOM_CVX 1.11 1.11

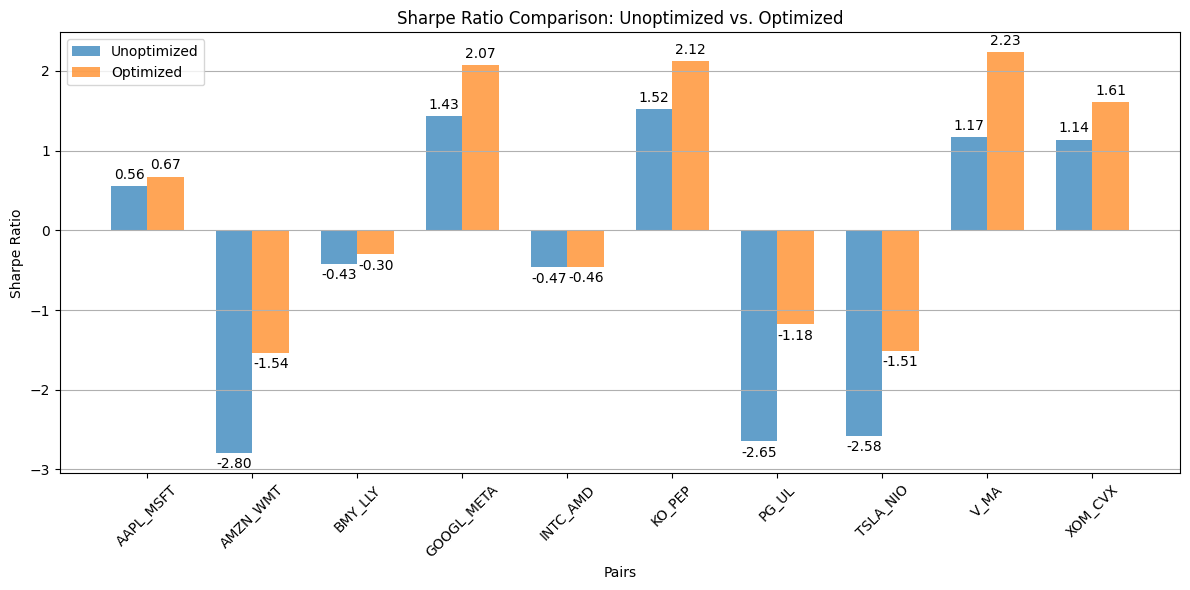

Performance Comparison:

--------------------------------------------------------------------------------

Pair Unopt. Sharpe Opt. Sharpe Improvement % Change

--------------------------------------------------------------------------------

AAPL_MSFT 0.5569 0.6734 +0.1165 +20.93 %

AMZN_WMT -2.7958 -1.5392 +1.2566 +44.94 %

BMY_LLY -0.4261 -0.3017 +0.1244 +29.20 %

GOOGL_META 1.4277 2.0749 +0.6473 +45.34 %

INTC_AMD -0.4664 -0.4559 +0.0105 +2.24 %

KO_PEP 1.5230 2.1212 +0.5982 +39.28 %

PG_UL -2.6487 -1.1808 +1.4679 +55.42 %

TSLA_NIO -2.5756 -1.5130 +1.0626 +41.26 %

V_MA 1.1698 2.2321 +1.0623 +90.81 %

XOM_CVX 1.1390 1.6075 +0.4685 +41.13 %

--------------------------------------------------------------------------------

TOTAL -3.0963 3.7184 +6.8147 +220.09 %

================================================================================

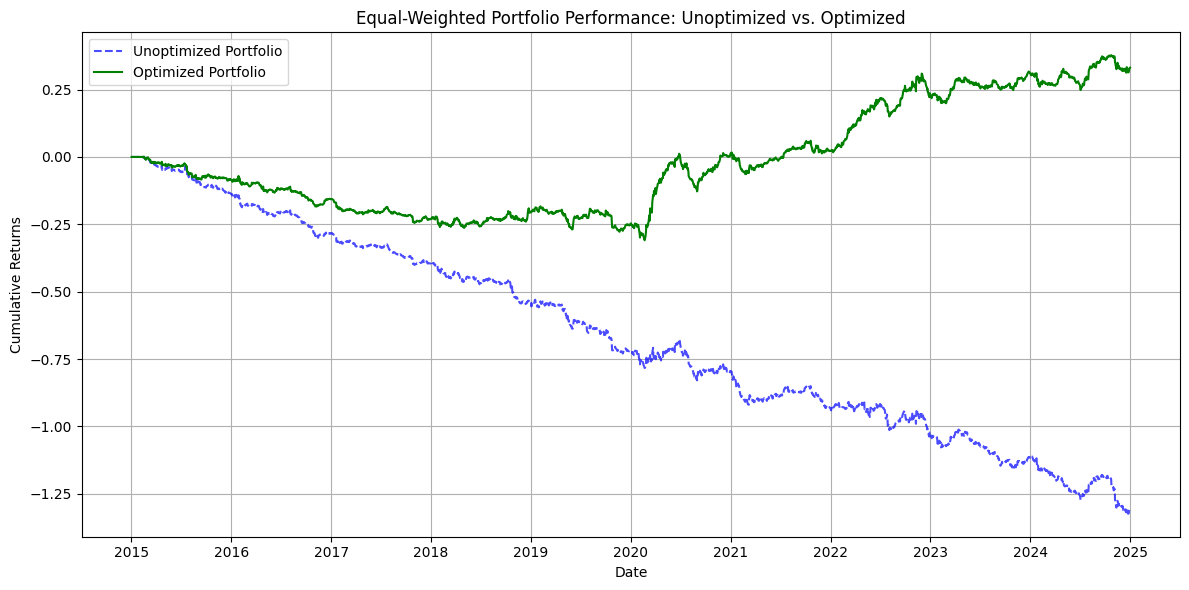

Compare overall portfolio metrics#

comparison = compare_strategies(unoptimized_results, optimized_results)

print("\nPortfolio-Level Performance Metrics:")

print(comparison)

Portfolio-Level Performance Metrics:

Unoptimized Optimized Improvement % Change

Total Return -1.307319 0.331325 1.638644 125.343872

Annualized Return -0.130940 0.033185 0.164125 125.343872

Annualized Volatility 0.079401 0.078473 -0.000928 -1.168595

Sharpe Ratio -1.649094 0.422886 2.071980 125.643542

Max Drawdown -1.324193 -0.310032 1.014160 76.587065

Calmar Ratio -0.098883 0.107038 0.205920 208.247311

Winning Pairs 5.000000 5.000000 0.000000 0.000000

Total Pairs 10.000000 10.000000 0.000000 0.000000

Plot results#

logging.info("Generating visualization plots...")

plot_cumulative_returns_unoptimized(unoptimized_results)

plot_cumulative_returns_optimized(optimized_results)

plot_sharpe_ratio_unoptimized(unoptimized_results)

plot_sharpe_ratio_optimized(optimized_results)

plot_drawdown_unoptimized(unoptimized_results)

plot_drawdown_optimized(optimized_results)

plot_sharpe_comparison(unoptimized_results, optimized_results)

plot_portfolio_comparison(unoptimized_results, optimized_results)

Plot parameter heatmap for first pair (as an example)#

if stock_data:

logging.info("Generating parameter optimization heatmap...")

plot_parameter_heatmap(stock_data, z_scores, pair_index=0)

logging.info("Analysis complete.")