Bilevel Markets#

Description: A notebook that presents a comprehensive mathematical formulation of strategic bidding in electricity markets using bilevel optimization and its equivalent single-level Mathematical Program with Equilibrium Constraints (MPEC) obtained through Karush-Kuhn-Tucker (KKT) transformation.

Tags: educational, bilevel, complementarity, amplpy, gurobi, knitro, baron, mpec, energy

Notebook author: Eduardo Salazar <eduardo@ampl.com>

Model author: Eduardo Salazar <eduardo@ampl.com>

References:

Luo, Pang, Ralph (1996) “Mathematical Programs with Equilibrium Constraints”: https://www.cambridge.org/core/books/mathematical-programs-with-equilibrium-constraints/03981C32ABDD55A4001BF58BA0C57444

Gabriel et al. (2013) “Complementarity Modeling in Energy Markets”: https://link.springer.com/book/10.1007/978-1-4419-6123-5

Fortuny-Amat & McCarl (1981) “A Representation and Economic Interpretation of a Two-Level Programming Problem”: https://www.jstor.org/stable/2581394

# Install dependencies

%pip install -q amplpy pandas matplotlib numpy

# Google Colab & Kaggle integration

from amplpy import AMPL, ampl_notebook

ampl = ampl_notebook(

modules=["gurobi", "knitro", "baron"], # modules to install

license_uuid="default", # license to use

) # instantiate AMPL object and register magics

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

Bilevel electricity markets problem#

Electricity markets exhibit complex strategic interactions where large generators can influence market prices through their bidding behavior. This creates a bilevel optimization problem where:

Upper Level (Leader): Strategic generators choose their bid prices to maximize profit, anticipating how the market will respond

Lower Level (Follower): The ISO clears the market by dispatching generators to minimize total bid cost, given all submitted bids

The key challenge is that the strategic generator’s profit depends on the market clearing price, which itself depends on all generators’ bids in a complex, non-linear way. This interdependence makes the problem non-convex and computationally challenging, even when each level individually is convex.

Key Insight: Bid vs. Cost#

A critical distinction in this model:

Bid (\(\text{bid}_i\)): What the generator tells the market it costs to produce

True Cost (\(c_i p_i + q_i p_i^2\)): What it actually costs to produce

Profit: Market price \(\times\) quantity: True cost (not bid!)

The strategic generator bids above its cost to maximize profit, knowing that the ISO will dispatch based on bids, not actual costs.

The strategic generator (Coal) solves:

Coal’s revenue depends on market price \(\lambda^*\) and its dispatch \(p_{\text{Coal}}^*\)

Coal’s cost is based on true cost, not the bid

The gap between bid and true cost is where profit comes from

Coal must predict how the ISO will respond to its bid

Lower Level Problem (ISO Market Clearing) Given the bids from all generators, the ISO solves:

ISO minimizes perceived cost based on submitted bids

ISO doesn’t know Coal’s true cost

Competitive generators bid their true marginal cost: \(bid_i = c_i\)

Numbers in parentheses (\(\nu, \mu_i^-, \mu_i^+\)) are dual variables (explained below)

Notation and Sets#

Index Sets#

Symbol |

Description |

|---|---|

\(\mathcal{G}\) |

Set of all generators (indexed by \(i\)) |

\(\mathcal{S} \subseteq \mathcal{G}\) |

Strategic generators (Stackelberg leaders) |

\(\mathcal{C} \subseteq \mathcal{G}\) |

Competitive generators (price-takers) |

Note: \(\mathcal{S} \cap \mathcal{C} = \emptyset\) and \(\mathcal{S} \cup \mathcal{C} = \mathcal{G}\).

Parameters#

Symbol |

Description |

Units |

|---|---|---|

\(D\) |

Total system demand |

MW |

\(c_i\) |

True marginal cost of generator \(i\) |

$/MWh |

\(q_i\) |

Quadratic cost coefficient |

$/MW²h |

\(\bar{p}_i\) |

Capacity limit of generator \(i\) |

MW |

The total cost for generator \(i\) to produce \(p_i\) MW is: \(C_i(p_i) = c_i p_i + q_i p_i^2\).

Decision Variables#

Symbol |

Description |

Level |

Units |

|---|---|---|---|

\(\text{bid}_i\) |

Bid price for generator \(i \in \mathcal{S}\) |

Upper |

$/MWh |

\(p_i\) |

Generation dispatch for \(i \in \mathcal{G}\) |

Lower |

MW |

\(\lambda\) |

Market clearing price (LMP) |

Lower |

$/MWh |

Dual Variables (for Lower Level)#

Symbol |

Description |

Units |

|---|---|---|

\(\nu\) |

Dual of power balance constraint |

$/MWh |

\(\mu_i^-\) |

Dual of lower bound \(p_i \geq 0\) |

$/MW |

\(\mu_i^+\) |

Dual of upper bound \(p_i \leq \bar{p}_i\) |

$/MW |

Original Bilevel Formulation#

Complete Mathematical Model#

Upper Level Problem (Strategic Generator)#

Lower Level Problem (Market Clearing by ISO)#

Given bids \(\{\text{bid}_i\}_{i \in \mathcal{S}}\) from strategic generators:

Market Price Definition#

The market clearing price is defined as:

where \(\nu\) is the dual variable (shadow price) of the power balance constraint (LL-1).

Economic Interpretation#

Upper Level Objective (UL-Obj)#

The strategic generator’s profit has two components:

Revenue: \(\lambda \cdot p_i\) — the market clearing price times the quantity sold

Cost: \(c_i \cdot p_i + q_i \cdot p_i^2\) — the actual cost of production

Key Point: The generator pays its true cost to produce power, not the bid. The bid only affects how much power it gets dispatched and what market price emerges.

Lower Level Objective (LL-Obj)#

The ISO minimizes total bid cost, not actual cost:

Strategic generators are dispatched based on their bids (\(\text{bid}_i\))

Competitive generators are dispatched based on their true costs (\(c_i\))

This is realistic: the ISO only knows what generators bid, not their actual costs.

Power Balance (LL-1)#

Supply must equal demand exactly:

The dual variable \(\nu\) represents the marginal cost of serving one additional MW of demand — this is the Locational Marginal Price (LMP).

Strategic Behavior#

The strategic generator faces a fundamental tradeoff:

Higher bid ⇒ Higher market price \(\lambda\) (if dispatched) BUT lower dispatch quantity \(p_i\)

Lower bid ⇒ Higher dispatch quantity BUT lower market price

The optimal bid balances these competing effects to maximize profit.

Why This is a Bilevel Problem#

The challenge is that constraint (UL-2) is an optimization problem, not a simple algebraic constraint. The upper level must find:

where \(p(\text{bid})\) and \(\lambda(\text{bid})\) are implicitly defined by the solution to the lower level problem. This implicit dependence is what makes bilevel problems difficult.

KKT-Transformed MPEC Formulation#

To solve the bilevel problem, we replace the lower level optimization (LL-Obj)–(LL-2) with its Karush-Kuhn-Tucker (KKT) necessary optimality conditions. This transforms the problem into a single-level Mathematical Program with Equilibrium Constraints (MPEC).

Complete MPEC Formulation#

Objective Function#

Constraints#

Primal Feasibility (Lower Level Constraints)

Dual Feasibility

Stationarity (Gradient of Lagrangian = 0)

For strategic generators (\(i \in \mathcal{S}\)):

For competitive generators (\(i \in \mathcal{C}\)):

Complementarity Slackness

Market Price Definition

Upper Level Constraint

Derivation of KKT Conditions#

Step 1: Formulate the Lagrangian#

The lower level problem (LL-Obj)–(LL-2) can be written in standard form:

The Lagrangian is:

Simplifying:

Step 2: Derive Stationarity Conditions#

Taking the partial derivative with respect to \(p_i\) for \(i \in \mathcal{S}\):

Rearranging:

Similarly for \(i \in \mathcal{C}\):

Step 3: Understanding Complementarity#

The complementarity condition (Comp-1) means:

This defines mutually exclusive cases:

If \(p_i > 0\) (generator is dispatched), then \(\mu_i^- = 0\)

If \(\mu_i^- > 0\) (lower bound is binding), then \(p_i = 0\)

Both can be zero simultaneously (degenerate case)

Similarly for (Comp-2):

If \(p_i < \bar{p}_i\) (not at capacity), then \(\mu_i^+ = 0\)

If \(\mu_i^+ > 0\) (at capacity), then \(p_i = \bar{p}_i\)

Economic Interpretation of KKT Conditions#

Stationarity: Marginal Pricing#

From equation (Stat-S), when both \(\mu_i^- = 0\) and \(\mu_i^+ = 0\) (interior solution):

This is the marginal generator — the generator whose bid sets the market price.

If \(\text{bid}_i < \lambda\): Generator produces at capacity (\(p_i = \bar{p}_i\), \(\mu_i^+ > 0\)), earning infra-marginal rent

If \(\text{bid}_i = \lambda\): Marginal generator, may produce anywhere in \([0, \bar{p}_i]\)

If \(\text{bid}_i > \lambda\): Generator doesn’t produce (\(p_i = 0\), \(\mu_i^- > 0\))

Dual Variables as Shadow Prices#

Dual |

Economic Meaning |

|---|---|

\(\nu\) |

Locational Marginal Price (LMP): Cost to serve one additional MW of demand |

\(\mu_i^-\) |

Startup value: How much we’d gain if we could dispatch generator \(i\) (when \(p_i = 0\)) |

\(\mu_i^+\) |

Capacity constraint shadow price: How much we’d gain from one more MW of capacity at generator \(i\) (when \(p_i = \bar{p}_i\)) |

Why \(\lambda = \nu\)?#

The dual variable \(\nu\) is the shadow price of the power balance constraint:

This is exactly the market clearing price: the marginal cost to serve one more unit of demand.

Why Complementarity Creates Non-Convexity#

Consider the feasible set defined by:

This is the union of two convex sets:

\(\{(\mu_i^-, p_i) : \mu_i^- = 0, \, p_i \geq 0\}\) — generator is on

\(\{(\mu_i^-, p_i) : \mu_i^- \geq 0, \, p_i = 0\}\) — generator is off

The union of convex sets is not convex. This is why MPEC problems are non-convex even when both levels are convex individually.

Remark: The complementarity condition represents a regime switch: the generator is either producing (\(p_i > 0\)) or not producing (\(p_i = 0\)). The optimization must implicitly decide which regime each generator is in, leading to a combinatorial explosion of possibilities.

Worked Example: Three-Generator System#

Consider a simple system to see how the conditions work:

Generator |

Type |

Cost \(c_i\) |

Capacity \(\bar{p}_i\) |

Bid |

|---|---|---|---|---|

Coal |

Strategic |

$10/MWh |

50 MW |

Decision variable |

Gas |

Competitive |

$15/MWh |

40 MW |

$15/MWh |

Peaker |

Competitive |

$25/MWh |

30 MW |

$25/MWh |

Suppose demand \(D = 100\) MW and the optimal solution is:

Coal bids $20/MWh and produces 50 MW (at capacity)

Gas produces 40 MW (at capacity)

Peaker produces 10 MW (interior)

Verification of KKT Conditions#

Power Balance (PF-1): \(50 + 40 + 10 = 100\) ✓

Stationarity:

For Coal (strategic, at capacity): $\( 20 - \nu - 0 + \mu_{\text{Coal}}^+ = 0 \implies \mu_{\text{Coal}}^+ = \nu - 20 \)$

For Peaker (competitive, interior): $\( 25 - \nu - 0 + 0 = 0 \implies \nu = 25 \)$

Therefore: \(\mu_{\text{Coal}}^+ = 25 - 20 = 5\) (shadow value of Coal’s capacity constraint)

Market Price: \(\lambda = \nu = \$25\)/MWh (set by Peaker’s bid)

Complementarity:

Coal: \(p_{\text{Coal}} = 50 = \bar{p}_{\text{Coal}}\) ✓ and \(\mu_{\text{Coal}}^+ = 5 > 0\) ✓

Peaker: \(0 < p_{\text{Peaker}} = 10 < 30\) ✓ so \(\mu_{\text{Peaker}}^- = \mu_{\text{Peaker}}^+ = 0\) ✓

Coal’s Profit: $\( \text{Profit} = \lambda \cdot p - c \cdot p = 25(50) - 10(50) = \$750 \)$

If Coal had bid its true cost ($10/MWh), it would still produce 50 MW, but the market price would be $25/MWh (set by Peaker), earning only $750. By bidding $20/MWh, Coal remains dispatched and maintains the high market price.

Connection to AMPL Implementation#

The MPEC formulation maps directly to AMPL code:

Mathematical Condition |

AMPL Code |

|---|---|

Primal feasibility (PF-1) |

|

Stationarity (Stat-S) |

|

Stationarity (Stat-C) |

|

Complementarity (Comp-1) |

|

Complementarity (Comp-2) |

|

Price definition (Price-Def) |

|

Bid lower bound (Bid-Bound) |

|

Key AMPL Feature: The complements keyword automatically handles the disjunctive complementarity constraints using Knitro’s MPEC algorithm. Without specialized solvers, these constraints would require mixed-integer reformulations.

Why the KKT Transformation is Valid#

The transformation from bilevel to MPEC is valid because:

Lower level is convex: Linear objective with linear constraints

Constraint qualification holds: Slater’s condition (feasible interior exists)

KKT conditions are necessary and sufficient for convex problems

Therefore, replacing “\((p^*, \lambda^*)\) solves the lower level” with “KKT conditions hold” is an exact reformulation, not an approximation.

Warning: For non-convex lower levels, KKT conditions are only necessary, not sufficient. This can lead to incorrect solutions where the upper level exploits non-global optima of the lower level.

Computational Complexity#

Even with the single-level reformulation, MPEC problems are:

NP-hard in general (due to complementarity)

Non-convex (feasible region is a union of polyhedra)

Multiple local optima possible (need global optimization or good initialization)

Specialized MPEC solvers like Knitro use:

Relaxation schemes to temporarily ignore complementarity

Sequential approaches that gradually enforce complementarity

Active set strategies to identify which constraints are binding

%%writefile bilevel_market.mod

# ===========================================================================

# bilevel_market.mod

# Bilevel Electricity Market Model - MPEC Formulation

# ===========================================================================

# Upper Level: Strategic generator maximizes profit by choosing bid

# Lower Level: ISO minimizes cost given all bids (market clearing)

# ===========================================================================

reset;

# Sets

set GENERATORS; # All generators

set STRATEGIC within GENERATORS; # Generators bidding strategically

set COMPETITIVE within GENERATORS; # Generators bidding at cost

# Parameters

param demand >= 0; # Total demand (MW)

param c {GENERATORS} >= 0; # True marginal cost ($/MWh)

param q {GENERATORS} >= 0; # Quadratic cost coefficient

param pmax {GENERATORS} >= 0; # Capacity limit (MW)

param VOLL default 30; # Value of Lost Load ($/MWh) - typical bid cap

param PRICE_FLOOR default 0; # Minimum price ($/MWh)

# Variables

var p {i in GENERATORS} >= 0, <= pmax[i]; # Generation dispatch (MW)

# Primal Feasibility - Inequality constraints (in variable bounds)

var lambda >= PRICE_FLOOR, <= VOLL; # Market price bounded by floor and VOLL

var bid {i in STRATEGIC} >= 0, <= VOLL; # Bids can't exceed market cap

# Dual variables with practical bounds

var mu_lower {GENERATORS} >= 0, <= VOLL; # Shadow price of lower bound

var mu_upper {GENERATORS} >= 0, <= VOLL; # Shadow price of upper bound

var nu >= -VOLL, <= VOLL; # Dual of power balance = price

# No bounds = free = dual feasibility for equality constraint

# ===========================================================================

# Upper Level: Strategic Generator Profit Maximization

# ===========================================================================

# Objective: Maximize strategic generator's profit

# Revenue = price * quantity

# Cost = true cost (not bid!)

maximize StrategicProfit:

sum {i in STRATEGIC} (lambda * p[i] - c[i] * p[i] - q[i] * p[i]^2);

# ===========================================================================

# Lower Level Constraints (Market Clearing) - As KKT Conditions

# ===========================================================================

# Power balance: supply = demand

subject to PowerBalance:

sum {i in GENERATORS} p[i] = demand;

# ===========================================================================

# KKT Conditions for Lower Level (ISO's Market Clearing Problem)

# ===========================================================================

# Lower level problem is:

# min sum{i in STRATEGIC} bid[i]*p[i] + sum{i in COMPETITIVE} c[i]*p[i]

# s.t. sum{i} p[i] = demand

# 0 <= p[i] <= pmax[i]

# ===========================================================================

# Stationarity: Gradient of Lagrangian = 0

# For strategic generators (bid is variable in upper level)

subject to Stationarity_Strategic {i in STRATEGIC}:

bid[i] - nu - mu_lower[i] + mu_upper[i] = 0;

# For competitive generators (bid = cost, fixed)

subject to Stationarity_Competitive {i in COMPETITIVE}:

c[i] - nu - mu_lower[i] + mu_upper[i] = 0;

# Complementarity: mu_lower[i] * p[i] = 0

# Dual feasibility for lower bound duals (embedded in complementarity)

subject to Comp_Lower {i in GENERATORS}:

mu_lower[i] >= 0 complements p[i] >= 0;

# ^^^^^^^^^^^ This part is dual feasibility

# Complementarity: mu_upper[i] * (pmax[i] - p[i]) = 0

# Dual feasibility for upper bound duals (embedded in complementarity)

subject to Comp_Upper {i in GENERATORS}:

mu_upper[i] >= 0 complements pmax[i] - p[i] >= 0;

# ^^^^^^^^^^^ This part is dual feasibility

# Market clearing price equals dual of power balance

subject to Price_Definition:

lambda = nu;

# Optional: Logical constraint - bid should be at least cost

# (Can be relaxed if testing predatory pricing)

subject to Bid_Lower_Bound {i in STRATEGIC}:

bid[i] >= c[i];

Overwriting bilevel_market.mod

The complements syntax in AMPL is doing double duty:

The mu_lower[i] >= 0 part enforces Dual Feasibility

The complements p[i] >= 0 part enforces Complementarity Slackness

So Comp_Lower and Comp_Upper actually encode both conditions 2 and 4!

This is why MPEC formulations in AMPL are so concise - the complementarity constraint captures two KKT conditions at once.

# @title

def solve_with_solver(ampl_instance, solver_name, solver_options=None, verbose=False):

"""

Solve the MPEC problem with a specified solver

Parameters:

-----------

ampl_instance : AMPL object

solver_name : str - 'baron', 'knitro', or 'gurobi'

solver_options : str - solver-specific options

verbose : bool - whether to print detailed output

Returns:

--------

dict with solution details

"""

if verbose:

print(f"\n{'='*70}")

print(f"SOLVING WITH {solver_name.upper()}")

print(f"{'='*70}")

# Configure solver

ampl_instance.option["solver"] = solver_name

if solver_options:

ampl_instance.option[f"{solver_name}_options"] = solver_options

# Solve

ampl_instance.option["reset_initial_guesses"] = 1

# Don't send info of solution to other solvers

result = ampl_instance.solve()

# Extract results

solve_result = ampl_instance.get_value("solve_result")

solve_time = ampl_instance.get_value("_total_solve_time")

# Get objective value

try:

objective = ampl_instance.obj["StrategicProfit"].value()

except:

objective = None

# Get market price

try:

market_price = ampl_instance.var["lambda"].value()

except:

market_price = None

# Get dispatch values

generators = list(ampl_instance.set["GENERATORS"])

dispatch = {}

bids = {}

for gen in generators:

try:

dispatch[gen] = ampl_instance.var["p"][gen].value()

except:

dispatch[gen] = None

if gen in ampl_instance.set["STRATEGIC"]:

try:

bids[gen] = ampl_instance.var["bid"][gen].value()

except:

bids[gen] = None

solution = {

"solver": solver_name,

"solve_result": solve_result,

"solve_time": solve_time,

"objective": objective,

"market_price": market_price,

"dispatch": dispatch,

"bids": bids,

}

if verbose:

print(f"\nSolve Result: {solve_result}")

print(f"Solve Time: {solve_time:.3f} seconds")

if objective is not None:

print(f"Strategic Profit: ${objective:.2f}")

if market_price is not None:

print(f"Market Price: ${market_price:.2f}/MWh")

return solution

def compare_solutions(solutions, gen_data):

"""

Create a comparison table of all solver results

"""

print(f"\n{'='*70}")

print("SOLVER COMPARISON SUMMARY")

print(f"{'='*70}\n")

# Create comparison dataframe

comparison_data = []

for sol in solutions:

row = {

"Solver": sol["solver"].upper(),

"Status": sol["solve_result"],

"Time (s)": f"{sol['solve_time']:.3f}",

"Profit ($)": f"{sol['objective']:.2f}" if sol["objective"] else "N/A",

"Price ($/MWh)": (

f"{sol['market_price']:.2f}" if sol["market_price"] else "N/A"

),

}

# Add dispatch for each generator

for gen in sol["dispatch"].keys():

dispatch_val = sol["dispatch"][gen]

row[f"{gen} Dispatch (MW)"] = (

f"{dispatch_val:.2f}" if dispatch_val else "N/A"

)

# Add bids for strategic generators

for gen in sol["bids"].keys():

bid_val = sol["bids"][gen]

row[f"{gen} Bid ($/MWh)"] = f"{bid_val:.2f}" if bid_val else "N/A"

comparison_data.append(row)

df_comparison = pd.DataFrame(comparison_data)

print(df_comparison.to_string(index=False))

# Check if solutions differ (indicating local optima)

print(f"\n{'='*70}")

print("LOCAL VS GLOBAL SOLVER ANALYSIS")

print(f"{'='*70}\n")

objectives = [s["objective"] for s in solutions if s["objective"] is not None]

if len(objectives) > 1:

max_obj = max(objectives)

min_obj = min(objectives)

print(f"Best objective found: ${max_obj:.2f}")

print(f"Worst objective found: ${min_obj:.2f}")

print(f"Difference: ${max_obj - min_obj:.2f}")

if abs(max_obj - min_obj) > 0.01: # Significant difference

print("\nDIFFERENT SOLUTIONS FOUND!")

print("This demonstrates that local solvers (Knitro) may find")

print(

"different local optima, while BARON (and Gurobi!) searches for global optimum."

)

# Identify which solver found the best solution

best_solver = [s["solver"] for s in solutions if s["objective"] == max_obj][

0

]

print(f"\nBest solution found by: {best_solver.upper()}")

else:

print("\nAll solvers converged to the same solution (within tolerance)")

return df_comparison

def visualize_comparison(solutions, gen_data, demand):

"""

Create visualization comparing solver results

"""

fig, axes = plt.subplots(2, 2, figsize=(14, 10))

fig.suptitle(

"Solver Comparison: BARON vs Knitro vs Gurobi", fontsize=16, fontweight="bold"

)

# Extract data for plotting

generators = list(solutions[0]["dispatch"].keys())

n_solvers = len(solutions)

# Plot 1: Objective values

ax1 = axes[0, 0]

solver_names = [s["solver"].upper() for s in solutions]

objectives = [s["objective"] if s["objective"] else 0 for s in solutions]

colors_obj = ["#27ae60" if s["solver"] == "baron" else "#e74c3c" for s in solutions]

bars = ax1.bar(

solver_names, objectives, color=colors_obj, alpha=0.7, edgecolor="black"

)

ax1.set_ylabel("Strategic Profit ($)", fontsize=11)

ax1.set_title("Objective Value Comparison", fontsize=12, fontweight="bold")

ax1.grid(axis="y", alpha=0.3)

# Add value labels

for bar in bars:

height = bar.get_height()

ax1.text(

bar.get_x() + bar.get_width() / 2.0,

height,

f"${height:.2f}",

ha="center",

va="bottom",

fontsize=9,

)

# Plot 2: Market prices

ax2 = axes[0, 1]

prices = [s["market_price"] if s["market_price"] else 0 for s in solutions]

bars = ax2.bar(solver_names, prices, color="#3498db", alpha=0.7, edgecolor="black")

ax2.set_ylabel("Price ($/MWh)", fontsize=11)

ax2.set_title("Market Clearing Price Comparison", fontsize=12, fontweight="bold")

ax2.grid(axis="y", alpha=0.3)

# Add value labels

for bar in bars:

height = bar.get_height()

ax2.text(

bar.get_x() + bar.get_width() / 2.0,

height,

f"${height:.2f}",

ha="center",

va="bottom",

fontsize=9,

)

# Plot 3: Dispatch comparison

ax3 = axes[1, 0]

x = np.arange(len(generators))

width = 0.25

for i, sol in enumerate(solutions):

dispatch_vals = [

sol["dispatch"][g] if sol["dispatch"][g] else 0 for g in generators

]

offset = width * (i - 1)

ax3.bar(

x + offset,

dispatch_vals,

width,

label=sol["solver"].upper(),

alpha=0.7,

edgecolor="black",

)

ax3.set_ylabel("Dispatch (MW)", fontsize=11)

ax3.set_title("Generation Dispatch Comparison", fontsize=12, fontweight="bold")

ax3.set_xticks(x)

ax3.set_xticklabels(generators)

ax3.legend()

ax3.grid(axis="y", alpha=0.3)

# Plot 4: Strategic bids comparison

ax4 = axes[1, 1]

strategic_gens = [g for g in generators if any(g in s["bids"] for s in solutions)]

if strategic_gens:

x = np.arange(len(strategic_gens))

for i, sol in enumerate(solutions):

bid_vals = [

sol["bids"].get(g, 0) if sol["bids"].get(g) else 0

for g in strategic_gens

]

offset = width * (i - 1)

ax4.bar(

x + offset,

bid_vals,

width,

label=sol["solver"].upper(),

alpha=0.7,

edgecolor="black",

)

# Add true costs as reference

true_costs = [gen_data[g]["c"] for g in strategic_gens]

ax4.plot(

x,

true_costs,

"r--",

linewidth=2,

marker="o",

label="True Cost",

markersize=8,

)

ax4.set_ylabel("Bid ($/MWh)", fontsize=11)

ax4.set_title("Strategic Bids Comparison", fontsize=12, fontweight="bold")

ax4.set_xticks(x)

ax4.set_xticklabels(strategic_gens)

ax4.legend()

ax4.grid(axis="y", alpha=0.3)

plt.tight_layout()

plt.savefig("solver_comparison.png", dpi=300, bbox_inches="tight")

print(f"\nComparison visualization saved to 'solver_comparison.png'\n")

plt.show()

# @title

def sensitivity_analysis_all_solvers(demand_range=None):

"""

Run sensitivity analysis across demand levels for all three solvers

Parameters:

-----------

demand_range : iterable - range of demand values to test

Returns:

--------

dict with sensitivity results for each solver

"""

if demand_range is None:

demand_range = range(60, 121, 10)

print("\n" + "=" * 70)

print("SENSITIVITY ANALYSIS: VARYING DEMAND")

print("=" * 70)

print(f"Testing demand levels: {list(demand_range)}")

print("=" * 70 + "\n")

# Initialize AMPL

global ampl

# Generator data

generators = ["Coal", "Gas", "Peaker"]

gen_data = {

"Coal": {"c": 10, "q": 0.1, "pmax": 50},

"Gas": {"c": 15, "q": 0.2, "pmax": 40},

"Peaker": {"c": 25, "q": 0.3, "pmax": 30},

}

# Define solvers to test

solvers_config = [

{"name": "baron", "options": "outlev=0"},

{"name": "knitro", "options": "outlev=0"},

{"name": "gurobi", "options": "outlev=0"},

]

# Store results for each solver

all_results = {solver["name"]: [] for solver in solvers_config}

# Run sensitivity analysis for each solver

for solver_cfg in solvers_config:

solver_name = solver_cfg["name"]

solver_options = solver_cfg["options"]

print(f"\nRunning sensitivity analysis with {solver_name.upper()}...")

for d in demand_range:

# Reset and configure AMPL

# ampl.reset()

# ampl.read('bilevel_market.mod')

ampl.set["GENERATORS"] = generators

ampl.set["STRATEGIC"] = ["Coal"]

ampl.set["COMPETITIVE"] = ["Gas", "Peaker"]

ampl.param["demand"] = d

for gen in generators:

ampl.param["c"][gen] = gen_data[gen]["c"]

ampl.param["q"][gen] = gen_data[gen]["q"]

ampl.param["pmax"][gen] = gen_data[gen]["pmax"]

# Solve

solution = solve_with_solver(

ampl, solver_name, solver_options, verbose=False

)

# Store results

result = {

"Demand (MW)": d,

"Solver": solver_name,

"Price ($/MWh)": (

solution["market_price"] if solution["market_price"] else np.nan

),

"Coal Dispatch (MW)": (

solution["dispatch"]["Coal"]

if solution["dispatch"]["Coal"]

else np.nan

),

"Coal Bid ($/MWh)": (

solution["bids"]["Coal"] if solution["bids"]["Coal"] else np.nan

),

"Coal Profit ($)": (

solution["objective"] if solution["objective"] else np.nan

),

"Gas Dispatch (MW)": (

solution["dispatch"]["Gas"]

if solution["dispatch"]["Gas"]

else np.nan

),

"Peaker Dispatch (MW)": (

solution["dispatch"]["Peaker"]

if solution["dispatch"]["Peaker"]

else np.nan

),

"Solve Time (s)": solution["solve_time"],

}

all_results[solver_name].append(result)

print(

f" Demand={d}MW: Profit=${result['Coal Profit ($)']:.2f}, "

+ f"Price=${result['Price ($/MWh)']:.2f}/MWh, "

+ f"Bid=${result['Coal Bid ($/MWh)']:.2f}/MWh"

)

return all_results, gen_data

def visualize_sensitivity_comparison(all_results, gen_data):

"""

Create comprehensive sensitivity analysis visualizations comparing all solvers

"""

fig, axes = plt.subplots(2, 3, figsize=(18, 10))

fig.suptitle(

"Sensitivity Analysis: Solver Comparison Across Demand Levels",

fontsize=16,

fontweight="bold",

)

# Convert results to dataframes for easier plotting

dfs = {}

for solver, results in all_results.items():

dfs[solver] = pd.DataFrame(results)

# Define colors for each solver

colors = {

"baron": "#27ae60", # Green

"knitro": "#e74c3c", # Red

"gurobi": "#3498db", # Blue

}

markers = {"baron": "o", "knitro": "s", "gurobi": "^"}

# Plot 1: Coal Profit vs Demand

ax1 = axes[0, 0]

for solver, df in dfs.items():

ax1.plot(

df["Demand (MW)"],

df["Coal Profit ($)"],

marker=markers[solver],

linewidth=2,

markersize=8,

label=solver.upper(),

color=colors[solver],

)

ax1.set_xlabel("Demand (MW)", fontsize=11)

ax1.set_ylabel("Strategic Generator Profit ($)", fontsize=11)

ax1.set_title("Profit vs Demand", fontsize=12, fontweight="bold")

ax1.legend()

ax1.grid(alpha=0.3)

# Plot 2: Market Price vs Demand

ax2 = axes[0, 1]

for solver, df in dfs.items():

ax2.plot(

df["Demand (MW)"],

df["Price ($/MWh)"],

marker=markers[solver],

linewidth=2,

markersize=8,

label=solver.upper(),

color=colors[solver],

)

ax2.set_xlabel("Demand (MW)", fontsize=11)

ax2.set_ylabel("Market Price ($/MWh)", fontsize=11)

ax2.set_title("Market Price vs Demand", fontsize=12, fontweight="bold")

ax2.legend()

ax2.grid(alpha=0.3)

# Plot 3: Coal Bid vs Demand

ax3 = axes[0, 2]

for solver, df in dfs.items():

ax3.plot(

df["Demand (MW)"],

df["Coal Bid ($/MWh)"],

marker=markers[solver],

linewidth=2,

markersize=8,

label=solver.upper(),

color=colors[solver],

)

# Add true cost line

ax3.axhline(

y=gen_data["Coal"]["c"],

color="red",

linestyle="--",

linewidth=2,

label="True Cost",

alpha=0.7,

)

ax3.set_xlabel("Demand (MW)", fontsize=11)

ax3.set_ylabel("Strategic Bid ($/MWh)", fontsize=11)

ax3.set_title("Coal Bid vs Demand", fontsize=12, fontweight="bold")

ax3.legend()

ax3.grid(alpha=0.3)

# Plot 4: Coal Dispatch vs Demand

ax4 = axes[1, 0]

for solver, df in dfs.items():

ax4.plot(

df["Demand (MW)"],

df["Coal Dispatch (MW)"],

marker=markers[solver],

linewidth=2,

markersize=8,

label=solver.upper(),

color=colors[solver],

)

ax4.axhline(

y=gen_data["Coal"]["pmax"],

color="gray",

linestyle="--",

linewidth=2,

label="Capacity",

alpha=0.7,

)

ax4.set_xlabel("Demand (MW)", fontsize=11)

ax4.set_ylabel("Coal Dispatch (MW)", fontsize=11)

ax4.set_title("Coal Dispatch vs Demand", fontsize=12, fontweight="bold")

ax4.legend()

ax4.grid(alpha=0.3)

# Plot 5: Profit Difference (vs BARON)

ax5 = axes[1, 1]

baron_profit = dfs["baron"]["Coal Profit ($)"].values

for solver, df in dfs.items():

if solver != "baron":

profit_diff = df["Coal Profit ($)"].values - baron_profit

ax5.plot(

df["Demand (MW)"],

profit_diff,

marker=markers[solver],

linewidth=2,

markersize=8,

label=f"{solver.upper()} - BARON",

color=colors[solver],

)

ax5.axhline(y=0, color="black", linestyle="-", linewidth=1)

ax5.set_xlabel("Demand (MW)", fontsize=11)

ax5.set_ylabel("Profit Difference vs BARON ($)", fontsize=11)

ax5.set_title(

"Solution Quality: Gap from Global Optimum", fontsize=12, fontweight="bold"

)

ax5.legend()

ax5.grid(alpha=0.3)

# Plot 6: Solve Time Comparison

ax6 = axes[1, 2]

for solver, df in dfs.items():

ax6.plot(

df["Demand (MW)"],

df["Solve Time (s)"],

marker=markers[solver],

linewidth=2,

markersize=8,

label=solver.upper(),

color=colors[solver],

)

ax6.set_xlabel("Demand (MW)", fontsize=11)

ax6.set_ylabel("Solve Time (seconds)", fontsize=11)

ax6.set_title("Computational Time Comparison", fontsize=12, fontweight="bold")

ax6.legend()

ax6.grid(alpha=0.3)

ax6.set_yscale("log") # Log scale since times can vary widely

plt.tight_layout()

plt.savefig("sensitivity_analysis_comparison.png", dpi=300, bbox_inches="tight")

print(

f"\nSensitivity analysis visualization saved to 'sensitivity_analysis_comparison.png'\n"

)

plt.show()

def analyze_sensitivity_results(all_results):

"""

Analyze and report on sensitivity results

"""

print(f"\n{'='*70}")

print("SENSITIVITY ANALYSIS SUMMARY")

print(f"{'='*70}\n")

# Convert to dataframes

dfs = {solver: pd.DataFrame(results) for solver, results in all_results.items()}

# Check for differences across solvers at each demand level

print("Checking for local optima across demand range...\n")

demand_levels = dfs["baron"]["Demand (MW)"].unique()

max_diff_overall = 0

worst_demand = None

for d in demand_levels:

profits = {}

for solver, df in dfs.items():

profit = df[df["Demand (MW)"] == d]["Coal Profit ($)"].values[0]

profits[solver] = profit

max_profit = max(profits.values())

min_profit = min(profits.values())

diff = max_profit - min_profit

if diff > max_diff_overall:

max_diff_overall = diff

worst_demand = d

if diff > 0.01: # Significant difference

print(f"Demand = {d} MW:")

for solver, profit in profits.items():

gap = max_profit - profit

status = "✓ BEST" if profit == max_profit else f" Gap: ${gap:.2f}"

print(f" {solver.upper():8s}: ${profit:8.2f} {status}")

print()

if max_diff_overall > 0.01:

print(

f"MAXIMUM DIFFERENCE: ${max_diff_overall:.2f} at demand = {worst_demand} MW"

)

print(f"\nThis confirms that local solvers can find different solutions")

print(f"depending on the problem instance (demand level).\n")

else:

print(f"All solvers found consistent solutions across all demand levels\n")

# Summary statistics

print(f"{'='*70}")

print("SUMMARY STATISTICS")

print(f"{'='*70}\n")

for solver, df in dfs.items():

print(f"{solver.upper()}:")

print(f" Average profit: ${df['Coal Profit ($)'].mean():.2f}")

print(f" Average solve time: {df['Solve Time (s)'].mean():.3f}s")

print(f" Total solve time: {df['Solve Time (s)'].sum():.3f}s")

print()

# @title

def solve_with_all_solvers():

"""

Solve the strategic bidding problem with BARON, Knitro, and Gurobi

at a single demand level

"""

# Initialize AMPL

global ampl

# ampl.reset()

# Load model

ampl.read("bilevel_market.mod")

# Set up data

generators = ["Coal", "Gas", "Peaker"]

ampl.set["GENERATORS"] = generators

ampl.set["STRATEGIC"] = ["Coal"]

ampl.set["COMPETITIVE"] = ["Gas", "Peaker"]

gen_data = {

"Coal": {"c": 10, "q": 0.1, "pmax": 50},

"Gas": {"c": 15, "q": 0.2, "pmax": 40},

"Peaker": {"c": 25, "q": 0.3, "pmax": 30},

}

demand = 100 # MW

ampl.param["demand"] = demand

for gen in generators:

ampl.param["c"][gen] = gen_data[gen]["c"]

ampl.param["q"][gen] = gen_data[gen]["q"]

ampl.param["pmax"][gen] = gen_data[gen]["pmax"]

# Solve with each solver

solutions = []

# 1. BARON

print("\n" + "=" * 70)

print("BARON: Global Optimization Solver")

print("=" * 70)

baron_solution = solve_with_solver(ampl, "baron", "outlev=1", verbose=True)

solutions.append(baron_solution)

# ampl.eval("reset;")

# Reset

# ampl.reset()

# ampl.read('bilevel_market.mod')

ampl.set["GENERATORS"] = generators

ampl.set["STRATEGIC"] = ["Coal"]

ampl.set["COMPETITIVE"] = ["Gas", "Peaker"]

ampl.param["demand"] = demand

for gen in generators:

ampl.param["c"][gen] = gen_data[gen]["c"]

ampl.param["q"][gen] = gen_data[gen]["q"]

ampl.param["pmax"][gen] = gen_data[gen]["pmax"]

# 2. Knitro

print("\n" + "=" * 70)

print("KNITRO: Local MPEC Solver")

print("=" * 70)

knitro_solution = solve_with_solver(ampl, "knitro", "outlev=1", verbose=True)

solutions.append(knitro_solution)

# ampl.eval("reset data;")

# Reset

# ampl.reset()

# ampl.read('bilevel_market.mod')

ampl.set["GENERATORS"] = generators

ampl.set["STRATEGIC"] = ["Coal"]

ampl.set["COMPETITIVE"] = ["Gas", "Peaker"]

ampl.param["demand"] = demand

for gen in generators:

ampl.param["c"][gen] = gen_data[gen]["c"]

ampl.param["q"][gen] = gen_data[gen]["q"]

ampl.param["pmax"][gen] = gen_data[gen]["pmax"]

# 3. Gurobi

print("\n" + "=" * 70)

print("GUROBI: General-purpose NLP Solver that solves the MP transformed problem")

print("=" * 70)

gurobi_solution = solve_with_solver(ampl, "gurobi", "outlev=1", verbose=True)

solutions.append(gurobi_solution)

# Compare results

comparison_df = compare_solutions(solutions, gen_data)

# Visualize comparison

visualize_comparison(solutions, gen_data, demand)

return solutions, comparison_df, gen_data

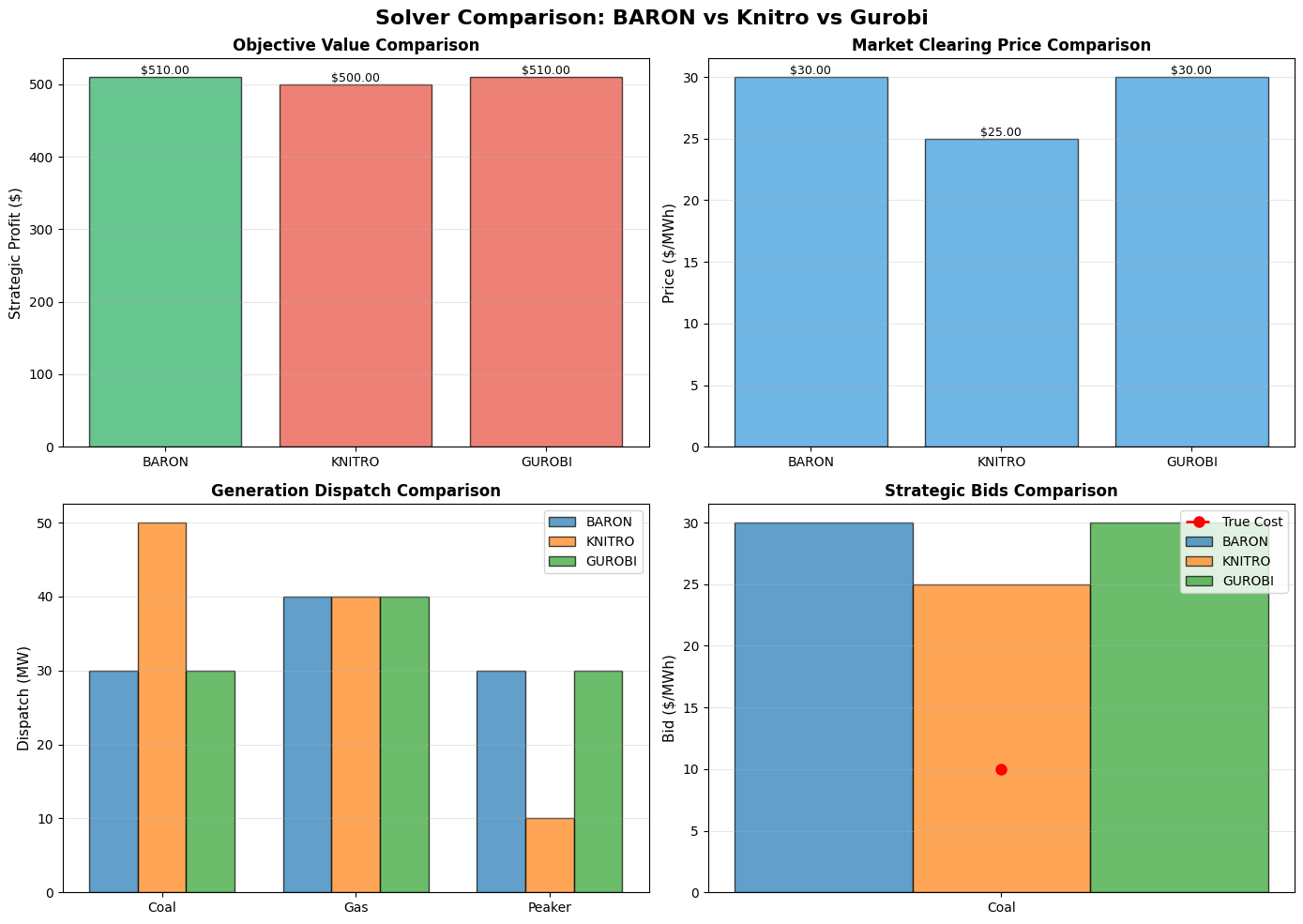

print("\n" + "=" * 70)

print("BILEVEL ELECTRICITY MARKET: SOLVER COMPARISON")

print("=" * 70)

print("\nThis analysis compares three solvers:")

print(" • BARON (Global solver)")

print(" • Knitro (Local MPEC solver)")

print(" • Gurobi (NLP solver, MP transforms complementarity)")

print("\n" + "=" * 70)

# Part 1: Single-point comparison at demand = 100 MW

print("\n\nPART 1: Single Demand Point Comparison")

print("=" * 70)

solutions, comparison_df, gen_data = solve_with_all_solvers()

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

======================================================================

BILEVEL ELECTRICITY MARKET: SOLVER COMPARISON

======================================================================

This analysis compares three solvers:

• BARON (Global solver)

• Knitro (Local MPEC solver)

• Gurobi (NLP solver, MP transforms complementarity)

======================================================================

PART 1: Single Demand Point Comparison

======================================================================

======================================================================

BARON: Global Optimization Solver

======================================================================

======================================================================

SOLVING WITH BARON

======================================================================

BARON 25.8.5 (2025.08.05): outlev=1

===========================================================================

BARON version 25.8.5. Built: LNX-int-64 2025-08-05 14:42:25

Running on machine cb43aae8992c

BARON is a product of The Optimization Firm.

For information on BARON, see https://minlp.com/about-baron

If you publish work using this software, please cite publications from

https://minlp.com/baron-publications, such as:

Zhang, Y. and N. V. Sahinidis, Solving continuous and discrete

nonlinear programs with BARON, Comput Optim Appl (2024).

https://doi.org/10.1007/s10589-024-00633-0

===========================================================================

This BARON run may utilize the following subsolver(s)

For LP/MIP/QP: CLP/CBC

For NLP: IPOPT, FILTERSQP

===========================================================================

Doing local search

Preprocessing found feasible solution with value 500.000

Solving bounding LP

Starting multi-start local search

Done with local search

===========================================================================

Iteration Time (s) Mem Lower bound Upper bound Progress

* 1+ 0.10 12MB 510.000 565.000 60.12%

1 0.10 12MB 510.000 510.000 100.00%

*** Normal completion ***

Wall clock time: 0.16

Total CPU time used: 0.10

Total no. of BaR iterations: 1

Best solution found at node: 1

Max. no. of nodes in memory: 1

All done

===========================================================================

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 510.0000001

Solve Result: solved

Solve Time: 0.165 seconds

Strategic Profit: $510.00

Market Price: $30.00/MWh

======================================================================

KNITRO: Local MPEC Solver

======================================================================

======================================================================

SOLVING WITH KNITRO

======================================================================

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Artelys Knitro 15.0.1: outlev=1

=======================================

Commercial License

Artelys Knitro 15.0.1

=======================================

Knitro using 1 thread.

Knitro presolve eliminated 4 variables and 4 constraints.

concurrent_evals 0

datacheck 0

feastol 1e-06

feastol_abs 0.001

findiff_numthreads 1

hessian_no_f 1

hessopt 1

opttol 1e-06

opttol_abs 0.001

outlev 1

The problem is linearly constrained.

The problem is identified as an MPEC.

Knitro fixing 1 variable eliminated from the presolve.

Knitro reinitializing 3 variables eliminated from the presolve after evaluation.

Problem Characteristics ( Presolved)

-----------------------

Objective goal: Maximize

Objective type: general

Number of variables: 13 ( 9)

bounded below only: 4 ( 5)

bounded above only: 0 ( 3)

bounded below and above: 9 ( 1)

fixed: 0 ( 0)

free: 0 ( 0)

Number of constraints: 10 ( 6)

linear equalities: 9 ( 6)

quadratic equalities: 0 ( 0)

gen. nonlinear equalities: 0 ( 0)

linear one-sided inequalities: 1 ( 0)

quadratic one-sided inequalities: 0 ( 0)

gen. nonlinear one-sided inequalities: 0 ( 0)

linear two-sided inequalities: 0 ( 0)

quadratic two-sided inequalities: 0 ( 0)

gen. nonlinear two-sided inequalities: 0 ( 0)

Number of complementarities: 2 ( 2)

Number of nonzeros in Jacobian: 21 ( 13)

Number of nonzeros in Hessian: 2 ( 2)

Knitro using the Interior-Point/Barrier Direct algorithm.

EXIT: Locally optimal solution found.

Final Statistics

----------------

Final objective value = 4.99999999986245e+02

Final feasibility error (abs / rel) = 2.78e-09 / 6.96e-11

Final optimality error (abs / rel) = 8.25e-09 / 1.65e-10

# of iterations = 7

# of CG iterations = 5

# of function evaluations = 12

# of gradient evaluations = 10

# of Hessian evaluations = 7

Total program time (secs) = 0.00341 ( 0.002 CPU time)

Time spent in evaluations (secs) = 0.00007

===============================================================================

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 500; feasibility error 2.78e-09

7 iterations; 12 function evaluations

suffix feaserror OUT;

suffix opterror OUT;

suffix numfcevals OUT;

suffix numiters OUT;

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Solve Result: solved

Solve Time: 0.178 seconds

Strategic Profit: $500.00

Market Price: $25.00/MWh

======================================================================

GUROBI: General-purpose NLP Solver

======================================================================

======================================================================

SOLVING WITH GUROBI

======================================================================

Gurobi 12.0.3: Set parameter LogToConsole to value 1

tech:outlev = 1

AMPL MP initial flat model has 11 variables (0 integer, 0 binary);

Objectives: 1 quadratic;

Constraints: 8 linear;

Logical expressions: 2 compl;

AMPL MP final model has 19 variables (2 integer, 4 binary);

Objectives: 1 quadratic;

Constraints: 10 linear;

Logical expressions: 4 indeq; 2 or;

Set parameter InfUnbdInfo to value 1

Gurobi Optimizer version 12.0.3 build v12.0.3rc0 (linux64 - "Ubuntu 22.04.4 LTS")

CPU model: Intel(R) Xeon(R) CPU @ 2.20GHz, instruction set [SSE2|AVX|AVX2]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

Non-default parameters:

InfUnbdInfo 1

Optimize a model with 10 rows, 19 columns and 21 nonzeros

Model fingerprint: 0x257cb504

Model has 2 quadratic objective terms

Model has 6 simple general constraints

2 OR, 4 INDICATOR

Variable types: 15 continuous, 4 integer (0 binary)

Coefficient statistics:

Matrix range [1e+00, 1e+00]

Objective range [1e+01, 1e+01]

QObjective range [2e-01, 2e+00]

Bounds range [1e+00, 5e+01]

RHS range [2e+01, 1e+02]

GenCon rhs range [3e+01, 5e+01]

GenCon coe range [1e+00, 1e+00]

Presolve removed 8 rows and 16 columns

Presolve time: 0.00s

Presolved: 5 rows, 7 columns, 13 nonzeros

Presolved model has 1 quadratic constraint(s)

Presolved model has 1 bilinear constraint(s)

Solving non-convex MIQCP

Variable types: 6 continuous, 1 integer (1 binary)

Found heuristic solution: objective 510.0000000

Root relaxation: objective 6.600000e+02, 2 iterations, 0.00 seconds (0.00 work units)

Nodes | Current Node | Objective Bounds | Work

Expl Unexpl | Obj Depth IntInf | Incumbent BestBd Gap | It/Node Time

0 0 660.00000 0 - 510.00000 660.00000 29.4% - 0s

0 0 574.99334 0 2 510.00000 574.99334 12.7% - 0s

0 0 cutoff 0 510.00000 510.00000 0.00% - 0s

Cutting planes:

Implied bound: 1

MIR: 1

Flow cover: 1

Relax-and-lift: 1

Explored 1 nodes (6 simplex iterations) in 0.01 seconds (0.00 work units)

Thread count was 2 (of 2 available processors)

Solution count 1: 510

Optimal solution found (tolerance 1.00e-04)

Best objective 5.100000000000e+02, best bound 5.100000000000e+02, gap 0.0000%

Gurobi 12.0.3: optimal solution; objective 510

6 simplex iterations

1 branching node

Solve Result: solved

Solve Time: 0.202 seconds

Strategic Profit: $510.00

Market Price: $30.00/MWh

======================================================================

SOLVER COMPARISON SUMMARY

======================================================================

Solver Status Time (s) Profit ($) Price ($/MWh) Coal Dispatch (MW) Gas Dispatch (MW) Peaker Dispatch (MW) Coal Bid ($/MWh)

BARON solved 0.165 510.00 30.00 30.00 40.00 30.00 30.00

KNITRO solved 0.178 500.00 25.00 50.00 40.00 10.00 24.99

GUROBI solved 0.202 510.00 30.00 30.00 40.00 30.00 30.00

======================================================================

LOCAL VS GLOBAL SOLVER ANALYSIS

======================================================================

Best objective found: $510.00

Worst objective found: $500.00

Difference: $10.00

DIFFERENT SOLUTIONS FOUND!

This demonstrates that local solvers (Knitro) may find

different local optima, while BARON (and Gurobi!) searches for global optimum.

Best solution found by: BARON

Comparison visualization saved to 'solver_comparison.png'

# Part 2: Sensitivity analysis across demand range

print("\n\nPART 2: Sensitivity Analysis Across Demand Range")

print("=" * 70)

all_results, gen_data = sensitivity_analysis_all_solvers(

demand_range=range(60, 121, 10)

)

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

PART 2: Sensitivity Analysis Across Demand Range

======================================================================

======================================================================

SENSITIVITY ANALYSIS: VARYING DEMAND

======================================================================

Testing demand levels: [60, 70, 80, 90, 100, 110, 120]

======================================================================

Running sensitivity analysis with BARON...

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 260

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

Demand=60MW: Profit=$260.00, Price=$25.00/MWh, Bid=$25.00/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 360

WARNING:amplpy:

Nonsquare complementarity system:

15 complementarities including 10 equations

16 variables

Demand=70MW: Profit=$360.00, Price=$25.00/MWh, Bid=$25.00/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 440

WARNING:amplpy:

Nonsquare complementarity system:

13 complementarities including 9 equations

14 variables

Demand=80MW: Profit=$440.00, Price=$25.00/MWh, Bid=$25.00/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 500

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=90MW: Profit=$500.00, Price=$25.00/MWh, Bid=$24.93/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 510.0000001

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=100MW: Profit=$510.00, Price=$30.00/MWh, Bid=$30.00/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 1 iterations, optimal within tolerances.

Objective 640.0000002

WARNING:amplpy:

Nonsquare complementarity system:

4 complementarities including 4 equations

9 variables

Demand=110MW: Profit=$640.00, Price=$30.00/MWh, Bid=$30.00/MWh

BARON 25.8.5 (2025.08.05): outlev=0

BARON 25.8.5 (2025.08.05): 0 iterations, optimal within tolerances.

Objective 750

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

Demand=120MW: Profit=$750.00, Price=$30.00/MWh, Bid=$30.00/MWh

Running sensitivity analysis with KNITRO...

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 62.50000001; feasibility error 7.61e-10

10 iterations; 15 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

Demand=60MW: Profit=$62.50, Price=$15.00/MWh, Bid=$15.00/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 359.9997106; feasibility error 4.8e-06

12 iterations; 17 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

15 complementarities including 10 equations

16 variables

Demand=70MW: Profit=$360.00, Price=$25.00/MWh, Bid=$25.00/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 440; feasibility error 1.92e-11

22 iterations; 27 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

13 complementarities including 9 equations

14 variables

Demand=80MW: Profit=$440.00, Price=$25.00/MWh, Bid=$25.00/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 499.9999996; feasibility error 4.87e-08

12 iterations; 18 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=90MW: Profit=$500.00, Price=$25.00/MWh, Bid=$25.00/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 500; feasibility error 2.78e-09

7 iterations; 12 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=100MW: Profit=$500.00, Price=$25.00/MWh, Bid=$24.99/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 499.9999535; feasibility error 9.3e-06

6 iterations; 11 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

4 complementarities including 4 equations

9 variables

Demand=110MW: Profit=$500.00, Price=$25.00/MWh, Bid=$24.98/MWh

Artelys Knitro 15.0.1: outlev=0

Knitro 15.0.1: Locally optimal or satisfactory solution.

objective 749.9999729; feasibility error 3.55e-15

5 iterations; 0 function evaluations

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

Demand=120MW: Profit=$750.00, Price=$30.00/MWh, Bid=$20.70/MWh

Running sensitivity analysis with GUROBI...

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 260

7 simplex iterations

1 branching node

absmipgap=0.00874243, relmipgap=3.36247e-05

WARNING:amplpy:

Nonsquare complementarity system:

17 complementarities including 11 equations

18 variables

Demand=60MW: Profit=$260.00, Price=$25.00/MWh, Bid=$25.00/MWh

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 360

12 simplex iterations

1 branching node

WARNING:amplpy:

Nonsquare complementarity system:

15 complementarities including 10 equations

16 variables

Demand=70MW: Profit=$360.00, Price=$25.00/MWh, Bid=$25.00/MWh

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 440

13 simplex iterations

1 branching node

WARNING:amplpy:

Nonsquare complementarity system:

13 complementarities including 9 equations

14 variables

Demand=80MW: Profit=$440.00, Price=$25.00/MWh, Bid=$25.00/MWh

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 500

3 simplex iterations

1 branching node

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=90MW: Profit=$500.00, Price=$25.00/MWh, Bid=$25.00/MWh

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 510

6 simplex iterations

1 branching node

WARNING:amplpy:

Nonsquare complementarity system:

9 complementarities including 7 equations

11 variables

Demand=100MW: Profit=$510.00, Price=$30.00/MWh, Bid=$30.00/MWh

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 640

3 simplex iterations

1 branching node

Demand=110MW: Profit=$640.00, Price=$30.00/MWh, Bid=$30.00/MWh

WARNING:amplpy:

Nonsquare complementarity system:

4 complementarities including 4 equations

9 variables

Gurobi 12.0.3: tech:outlev = 0

Gurobi 12.0.3: optimal solution; objective 750

0 simplex iterations

Demand=120MW: Profit=$750.00, Price=$30.00/MWh, Bid=$10.00/MWh

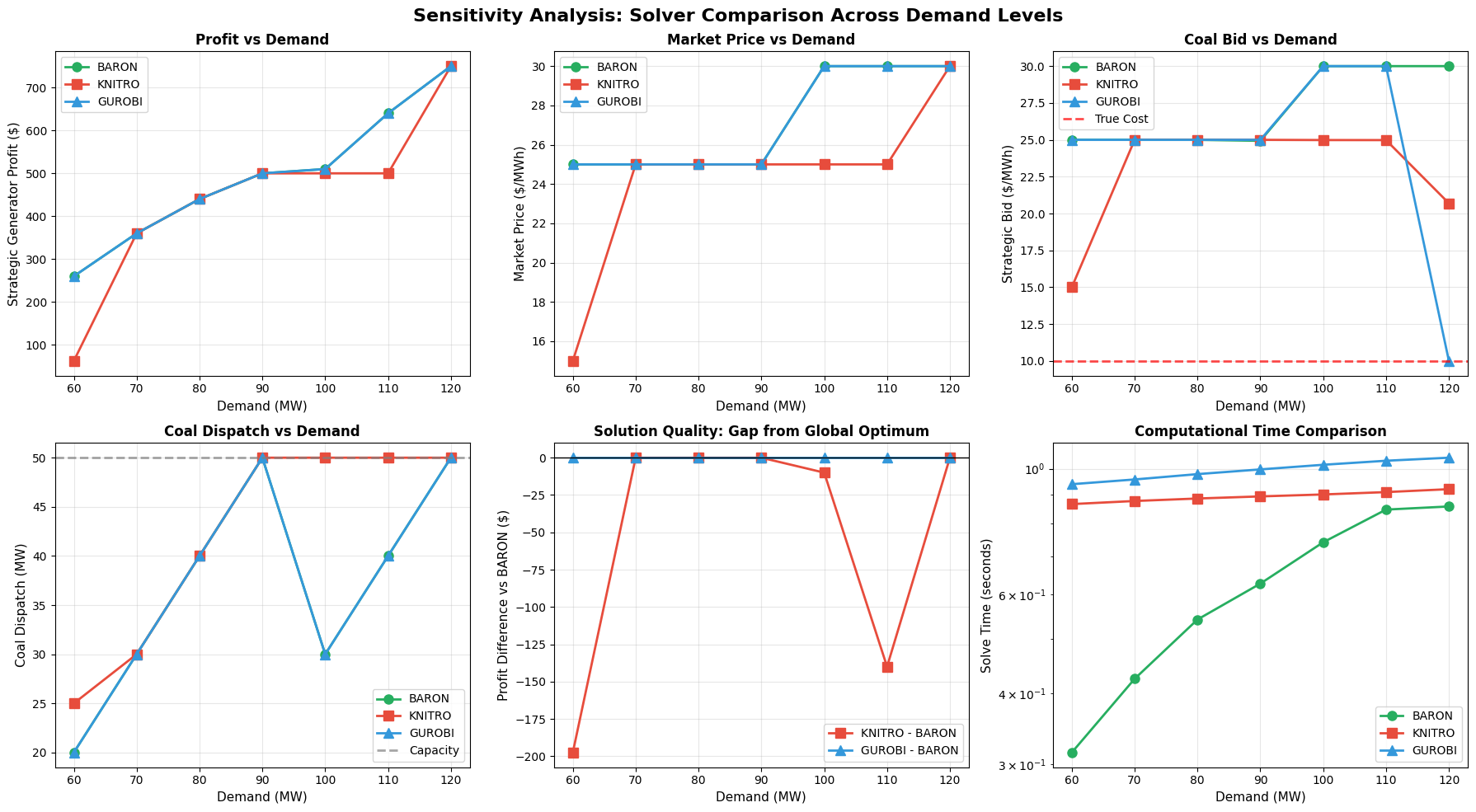

# Visualize sensitivity results

visualize_sensitivity_comparison(all_results, gen_data)

# Analyze sensitivity results

analyze_sensitivity_results(all_results)

print("\n" + "=" * 70)

print("ANALYSIS COMPLETE")

print("=" * 70)

print("\nGenerated files:")

print(" • solver_comparison.png")

print(" • sensitivity_analysis_comparison.png")

Sensitivity analysis visualization saved to 'sensitivity_analysis_comparison.png'

======================================================================

SENSITIVITY ANALYSIS SUMMARY

======================================================================

Checking for local optima across demand range...

Demand = 60 MW:

BARON : $ 260.00 Gap: $0.00

KNITRO : $ 62.50 Gap: $197.50

GUROBI : $ 260.00 ✓ BEST

Demand = 100 MW:

BARON : $ 510.00 ✓ BEST

KNITRO : $ 500.00 Gap: $10.00

GUROBI : $ 510.00 Gap: $0.00

Demand = 110 MW:

BARON : $ 640.00 ✓ BEST

KNITRO : $ 500.00 Gap: $140.00

GUROBI : $ 640.00 Gap: $0.00

MAXIMUM DIFFERENCE: $197.50 at demand = 60 MW

This confirms that local solvers can find different solutions

depending on the problem instance (demand level).

======================================================================

SUMMARY STATISTICS

======================================================================

BARON:

Average profit: $494.29

Average solve time: 0.622s

Total solve time: 4.352s

KNITRO:

Average profit: $444.64

Average solve time: 0.893s

Total solve time: 6.251s

GUROBI:

Average profit: $494.29

Average solve time: 0.995s

Total solve time: 6.967s

======================================================================

ANALYSIS COMPLETE

======================================================================

Generated files:

• solver_comparison.png

• sensitivity_analysis_comparison.png

Understanding the Optimization Landscape: Why Solvers Differ at Certain Demand Levels#

This sensitivity analysis reveals a fundamental characteristic of bilevel electricity market problems: the optimization landscape changes dramatically across different demand levels, creating regions where local and global solvers behave very differently.

Executive Summary of Results#

Demand Range |

BARON (Global) |

Knitro (Local) |

Gap |

Interpretation |

|---|---|---|---|---|

60 MW |

$260 |

$62.50 |

$197.50 |

Multiple local optima |

70-90 MW |

$360-500 |

$360-500 |

$0 |

Unique global optimum |

100-110 MW |

$510-640 |

$500 |

$10-140 |

Regime transition creates local trap |

120 MW |

$750 |

$750 |

$0 |

Degenerate case (infinite optima) |

The Four Market Regimes#

Regime 1: Low Demand (60 MW) - Multiple Local Optima#

Market Structure:

Total demand = 60 MW

Expected dispatch: Coal (50 MW) + Gas (10 MW)

Peaker: OFF

Why Multiple Optima Exist:

At low demand, Coal faces a non-convex tradeoff:

Strategy A (Knitro’s trap): Bid low (~$15/MWh)

Compete directly with Gas

Low price, minimal profit

Local optimum: $62.50 profit

Strategy B (Global optimum): Bid high (~$25/MWh)

Threaten Peaker entry

High price, full dispatch at capacity

Global optimum: $260 profit

The complementarity constraints create two “hills” in the profit landscape, and Knitro gets stuck on the lower one.

Regime 2: Stable Region (70-90 MW) - UNIQUE Optimum#

Market Structure:

Coal: Always at capacity (50 MW)

Gas: Interior dispatch (20-40 MW)

Peaker: Threatening but not dispatched

Why All Solvers Agree:

This is the “Goldilocks zone” of the optimization landscape:

Optimal Strategy = Bid at \$25/MWh (Peaker's cost)

Why this is unique:

• Bid > \$25 → Peaker enters, Coal loses dispatch

• Bid < \$25 → Leaves money on table

• Bid = \$25 → Maximizes profit while keeping Peaker out

Economic Intuition:

Peaker’s cost ($25/MWh) creates a clear price ceiling

Any generator bidding above this gets displaced

This constraint eliminates ambiguity

Problem becomes locally convex in this regime

Mathematical Property: The (KKT) conditions have a unique solution because:

The active constraints are unambiguous (Peaker entry threat)

The Jacobian has full rank

No regime-switching occurs in this range

Regime 3: Transition Zone (100-110 MW) - The Critical Insight#

This is where the story gets interesting.

The Regime Change at 90 → 100 MW:

At 90 MW:

Gas hits capacity (40 MW)

Peaker still not needed

Optimal: Bid $25, Profit $500

At 100 MW:

Need 10 MW from Peaker

Peaker becomes ACTIVE in dispatch

New optimal: Bid $30, Profit $510

But old strategy ($25 bid) is still locally optimal!

Why Knitro Gets Stuck:

The Optimization Landscape at 100 MW:

Profit

│

│ ╱╲ ╱╲

│ ╱ ╲ ╱ ╲

│ ╱ ╲ ╱ ╲

│ ╱ ╲ ╱ ╲

│ ╱ Local ╲ ╱ Global ╲

│╱ Max ╲__________╱ Max ╲

└─────────────────────────────────────> Coal Bid

$15 $25 $30 ($/MWh)

↑ ↑

Knitro BARON

(Old regime) (New regime)

Knitro’s Perspective:

Starts from some initialization

Follows algorithm to nearest peak

Converges to bid = $25, profit = $500

This satisfies all KKT conditions locally

Small perturbations don’t improve profit

Algorithm terminates: “Locally optimal solution found”

The Problem:

There’s a “valley” between the two peaks

Moving from $25 → $30 requires crossing this valley

Need global search to find the better peak

BARON’s Advantage:

Uses branch-and-bound with spatial branching

Explores both regimes systematically

Not trapped by local optimal solutions

Finds the discontinuous improvement

At 110 MW: The gap widens to $140 because:

Global optimum moves to $640 (more Peaker dispatch = higher profit)

Local optimum stays stuck at $500 (old regime)

The “valley” deepens, making escape even harder

Regime 4: Capacity Constraint (120 MW) - Degeneracy#

Market Structure:

ALL generators at 100% capacity

Total capacity = demand (120 = 120)

No dispatch flexibility remaining

Why Solutions Differ in Bid but Not Profit:

At capacity, Coal’s profit becomes:

π = λ·p - c·p - q·p²

π = 30×50 - 10×50 - 0.1×(50)²

π = $750

Notice: The bid variable doesn't appear!

The Bid is Irrelevant:

Coal must produce 50 MW regardless of bid

Market price = $30/MWh (set by scarcity, not bids)

Any bid from 10 to 30 dollars/MWh yields same profit

This Creates Infinite Optimal Solutions:

BARON picks: Bid $30

Knitro picks: Bid $20.70

Gurobi picks: Bid $10

All are globally optimal!

This is a degenerate case - the capacity constraint eliminates all strategic value of bidding.

Mathematical Explanation: Complementarity and Non-Convexity#

Why Complementarity Creates Multiple Optima:

The KKT conditions for the lower level include:

Stationarity: bid - ν - μ⁻ + μ⁺ = 0

Complementarity: μ⁺·(pmax - p) = 0

μ⁻·p = 0

The complementarity conditions mean:

Either: μ⁺ = 0 OR p = pmax (generator at capacity or not)

Either: μ⁻ = 0 OR p = 0 (generator on or off)

This creates discrete regimes:

Regime A: Coal at capacity, Gas interior, Peaker off

Regime B: Coal at capacity, Gas at capacity, Peaker interior

Each regime has its own local optimum

Switching regimes requires discrete jump

The Feasible Region is Non-Convex:

Feasible set = Union of regime-specific polytopes

= {(p, μ) : Regime A conditions} ∪ {(p, μ) : Regime B conditions}

The union of convex sets is not convex → multiple local optima possible.

Economic Interpretation: Market Power and Regime Transitions#

What This Tells Us About Electricity Markets:

Strategic Bidding is Regime-Dependent

At 70-90 MW: Bid at Peaker cost ($25)

At 100+ MW: Bid at price cap ($30)

Strategy changes discontinuously

Market Power Varies with Load

Low/high demand: Multiple equilibria (strategic complexity)

Medium demand: Unique equilibrium (clear constraints)

This matches real-world market observations

Transition Points are Critical

When Gas hits capacity (90 MW)

When Peaker becomes active (100 MW)

These are where market manipulation is most complex

Scarcity Reduces Strategic Value

At 120 MW (full capacity), bidding doesn’t matter

Price is set by scarcity, not strategy

Real markets also see this during peak demand

Key Takeaways for MPEC Problems#

Test Across Operating Range

Don’t validate on a single point

Identify regime transitions

Check solver consistency across conditions

Local Optima are Problem-Dependent

70-90 MW: No local optima (well-behaved)

60, 100-110 MW: Multiple local optima (transitions)

Location of optima depends on market structure

Economic Validation is Essential

Does the solution make economic sense?

Are generators dispatched in merit order?

Does price reflect marginal cost or scarcity?

Complementarity is the Culprit

Creates discrete regimes (on/off, at capacity/interior)

Regimes have different local optima

Global search needed to compare across regimes

For Further Reading#

This phenomenon is well-documented in the literature:

Luo, Pang, Ralph (1996): “Mathematical Programs with Equilibrium Constraints”

Gabriel et al. (2013): “Complementarity Modeling in Energy Markets”

Fortuny-Amat & McCarl (1981): “A Representation and Economic Interpretation of a Two-Level Programming Problem”

The sensitivity analysis presented here provides empirical evidence of these theoretical predictions in a realistic electricity market setting.

Understanding AMPL Complementarity Constraint Syntax#

AMPL provides specialized syntax for complementarity constraints that are essential for MPEC formulations. The complements operator connects two conditions that must hold in a mutually exclusive way.

Basic Form: Single-Inequality Complements Single-Inequality#

The most common form in MPEC problems is:

single-inequality complements single-inequality;

Satisfaction Conditions:

Both inequalities must be satisfied

At least one must hold with equality (i.e., be binding)

Example from Our Model:

subject to Comp_Lower {i in GENERATORS}:

mu_lower[i] >= 0 complements p[i] >= 0;

What This Means:

Both \(\mu_i^- \geq 0\) and \(p_i \geq 0\) must be satisfied

Additionally: Either \(\mu_i^- = 0\) OR \(p_i = 0\) (or both)

This encodes the complementarity condition: \(\mu_i^- \cdot p_i = 0\)

Valid Configurations:

Case |

\(\mu_i^-\) |

\(p_i\) |

Interpretation |

|---|---|---|---|

1 |

\(= 0\) |

\(> 0\) |

Generator is dispatched, lower bound not binding |

2 |

\(> 0\) |

\(= 0\) |

Generator not dispatched, would cost too much to turn on |

3 |

\(= 0\) |

\(= 0\) |

Degenerate case (both at boundary) |

Invalid Configuration:

Both \(\mu_i^- > 0\) AND \(p_i > 0\) (both strictly positive violates complementarity)

Double-Inequality Form#

A more general form uses a double-sided inequality:

double-inequality complements expression;

or equivalently:

expression complements double-inequality;

Example:

subject to Comp_Upper_Alt {i in GENERATORS}:

mu_upper[i] complements 0 <= p[i] <= pmax[i];

Satisfaction Conditions:

If left side of double-inequality is binding (\(p_i = 0\)), then \(\mu_i^+ \geq 0\)

If right side of double-inequality is binding (\(p_i = \bar{p}_i\)), then \(\mu_i^+ \leq 0\)

If neither side is binding (\(0 < p_i < \bar{p}_i\)), then \(\mu_i^+ = 0\)

Special Case: When the double-inequality is 0 <= variable <= Infinity, this reduces to standard complementarity. This is why our model uses:

subject to Comp_Upper {i in GENERATORS}:

mu_upper[i] >= 0 complements pmax[i] - p[i] >= 0;

Here, the slack variable is \((pmax[i] - p[i]) \geq 0\), which ensures:

If \(p_i = pmax[i]\) (at capacity), then slack \(= 0\), so \(\mu_i^+ > 0\) is allowed

If \(p_i < pmax[i]\) (not at capacity), then slack \(> 0\), so \(\mu_i^+ = 0\) is required

Comparison: Two Ways to Write the Same Constraint#

Our model uses the single-inequality form for clarity:

# What we use (explicit slack variable)

subject to Comp_Upper {i in GENERATORS}:

mu_upper[i] >= 0 complements pmax[i] - p[i] >= 0;

Alternative using double-inequality form:

# Equivalent formulation

subject to Comp_Upper_Alt {i in GENERATORS}:

mu_upper[i] complements 0 <= p[i] <= pmax[i];

Both are mathematically equivalent, but the first form makes the complementarity relationship more explicit: $\(\mu_i^+ \cdot (\bar{p}_i - p_i) = 0\)$

Why This Syntax Matters for MPEC#

The complements operator tells AMPL to:

Recognize this as a complementarity constraint, not a regular constraint

Invoke MPEC-capable solvers (like Knitro with

ms_enable=1)Use specialized algorithms that handle the non-convex, disjunctive nature

Without complements: If you tried to write this as a regular constraint:

# WRONG - This won't work!

subject to Comp_Lower_Wrong {i in GENERATORS}:

mu_lower[i] * p[i] = 0; # Ordinary constraint

Problems:

Creates a bilinear constraint (non-convex)

Standard NLP solvers will struggle

No indication to AMPL that this is complementarity

May converge to infeasible or suboptimal solutions

With complements: AMPL passes the problem to Knitro’s MPEC mode, which:

Uses sequential relaxation schemes

Gradually enforces complementarity

Handles the regime-switching structure correctly

Practical Tips for Writing Complementarity Constraints#

1. Always Check Variable Bounds Match Complementarity

# Variable declaration

var p {i in GENERATORS} >= 0, <= pmax[i];

# Corresponding complementarity

subject to Comp_Lower {i in GENERATORS}:

mu_lower[i] >= 0 complements p[i] >= 0; # ✓ Matches lower bound

subject to Comp_Upper {i in GENERATORS}:

mu_upper[i] >= 0 complements pmax[i] - p[i] >= 0; # ✓ Matches upper bound

2. Dual Variables Should Be Free or Non-Negative

var nu; # Free (dual of equality)

var mu_lower {GENERATORS} >= 0; # Non-negative (dual of inequality)

var mu_upper {GENERATORS} >= 0; # Non-negative (dual of inequality)

3. Use Meaningful Names for Slack Variables

Instead of:

mu_upper[i] >= 0 complements pmax[i] - p[i] >= 0;

You could define:

var slack_upper {i in GENERATORS} = pmax[i] - p[i];

subject to Comp_Upper {i in GENERATORS}:

mu_upper[i] >= 0 complements slack_upper[i] >= 0;

This makes debugging easier.

4. Verify Complementarity Numerically

After solving, always check:

for gen in generators:

mu_l = ampl.var['mu_lower'][gen].value()

mu_u = ampl.var['mu_upper'][gen].value()

p_val = ampl.var['p'][gen].value()

slack_u = pmax[gen] - p_val

viol_l = abs(mu_l * p_val)

viol_u = abs(mu_u * slack_u)

if viol_l > 1e-6 or viol_u > 1e-6:

print(f"WARNING: Complementarity violation for {gen}")

print(f" mu_lower * p = {viol_l:.2e}")

print(f" mu_upper * slack = {viol_u:.2e}")

Small violations (\(< 10^{-6}\)) are normal due to numerical tolerances.

Summary: Complementarity in Our Electricity Market Model#

Our model uses complementarity constraints to encode the KKT conditions of the lower level (ISO’s market clearing problem):

Mathematical Condition |

AMPL Syntax |

Meaning |

|---|---|---|

\(\mu_i^- \geq 0, \, p_i \geq 0, \, \mu_i^- \cdot p_i = 0\) |

|

If generator produces, lower bound not binding |

\(\mu_i^+ \geq 0, \, (\bar{p}_i - p_i) \geq 0, \, \mu_i^+ \cdot (\bar{p}_i - p_i) = 0\) |

|

If not at capacity, upper bound not binding |

These complementarity constraints, combined with:

Primal feasibility (PowerBalance, variable bounds)

Stationarity (Stationarity_Strategic, Stationarity_Competitive)

Price definition (lambda = nu)

…completely characterize the solution to the lower level problem, allowing us to solve the entire bilevel problem as a single-level MPEC.

The complements operator is what makes MPEC modeling in AMPL both elegant and computationally tractable. It tells the solver “these two things can’t both be strictly positive—handle the regime-switching logic appropriately.”